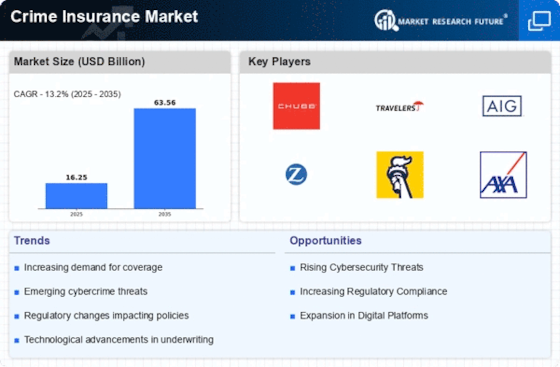

Rising Crime Rates

The Crime Insurance Market is experiencing a notable surge in demand due to rising crime rates across various regions. As urbanization continues to expand, incidents of theft, fraud, and vandalism have escalated, prompting businesses and individuals to seek protection against potential losses. According to recent statistics, property crime rates have increased by approximately 5% in several metropolitan areas, leading to heightened awareness of the need for crime insurance. This trend indicates that consumers are increasingly recognizing the value of safeguarding their assets, thereby driving growth in the Crime Insurance Market. Insurers are responding by developing tailored policies that address specific risks associated with different types of crime, further enhancing the appeal of crime insurance products.

Evolving Business Models

The evolution of business models, particularly in the retail and e-commerce sectors, is reshaping the Crime Insurance Market. As businesses increasingly operate online, they face unique risks associated with cybercrime, including data breaches and identity theft. This shift has led to a demand for specialized crime insurance products that address these emerging threats. Additionally, traditional brick-and-mortar businesses are also adapting to new consumer behaviors, which may expose them to different types of criminal activities. Insurers are responding by developing innovative policies that cater to the specific needs of these evolving business models. This adaptability is likely to drive growth in the Crime Insurance Market as companies seek comprehensive coverage to protect against a wider array of risks.

Technological Advancements

Technological advancements play a pivotal role in shaping the Crime Insurance Market. The integration of sophisticated security systems, such as surveillance cameras and alarm systems, has not only deterred criminal activities but also influenced insurance underwriting processes. Insurers are increasingly utilizing data analytics and artificial intelligence to assess risk profiles more accurately, which can lead to more competitive pricing for policyholders. Furthermore, the rise of cybercrime has necessitated the inclusion of cyber liability coverage in crime insurance policies. As businesses invest in technology to protect themselves, the demand for comprehensive crime insurance solutions is likely to grow, indicating a dynamic shift in the Crime Insurance Market.

Regulatory Changes and Compliance

Regulatory changes and compliance requirements are increasingly influencing the Crime Insurance Market. Governments are implementing stricter regulations aimed at protecting consumers and businesses from financial losses due to crime. These regulations often mandate that certain industries maintain specific levels of insurance coverage, thereby creating a steady demand for crime insurance products. For instance, financial institutions are required to have robust fraud protection measures in place, which often includes crime insurance. As compliance becomes a critical factor for businesses, the Crime Insurance Market is likely to see sustained growth as organizations seek to align with regulatory standards and protect their interests.

Increased Awareness of Financial Risks

There is a growing awareness among businesses and individuals regarding the financial risks associated with crime, which is significantly impacting the Crime Insurance Market. As organizations face potential losses from criminal activities, they are more inclined to invest in crime insurance as a risk management strategy. Recent surveys indicate that nearly 60% of small to medium-sized enterprises now consider crime insurance a necessary component of their overall risk management framework. This shift in perception is likely to drive demand for crime insurance products, as stakeholders seek to mitigate financial exposure. Consequently, insurers are adapting their offerings to meet the evolving needs of clients, further propelling the growth of the Crime Insurance Market.