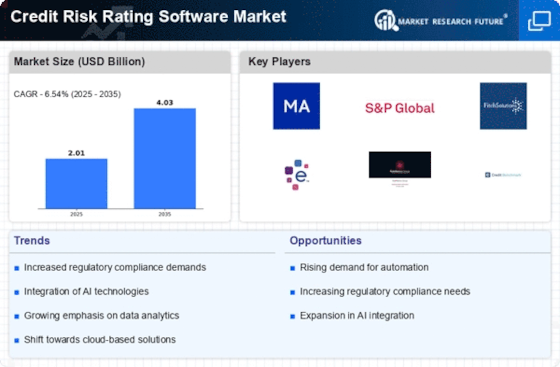

The Credit Risk Rating Software Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for robust risk assessment tools amid evolving financial regulations and market volatility. Key players such as Moody's Analytics (US), S&P Global (US), and FICO (US) are strategically positioned to leverage their extensive data analytics capabilities and established reputations. These companies focus on innovation and digital transformation, enhancing their software solutions to provide more accurate and timely risk assessments. Their collective strategies not only shape the competitive environment but also set a high bar for emerging players, fostering a culture of continuous improvement and technological advancement.

In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, optimizing their supply chains to enhance efficiency. The market appears moderately fragmented, with a mix of established firms and newer entrants vying for market share. The influence of key players is substantial, as they often dictate industry standards and best practices, thereby shaping the overall market structure.

In August 2025, Moody's Analytics (US) announced a partnership with a leading fintech firm to integrate advanced machine learning algorithms into their credit risk assessment tools. This strategic move is likely to enhance the predictive accuracy of their models, allowing clients to make more informed lending decisions. Such collaborations indicate a trend towards leveraging technology to improve service offerings and meet the growing expectations of clients.

In September 2025, S&P Global (US) launched a new suite of credit risk solutions designed specifically for small and medium-sized enterprises (SMEs). This initiative reflects a strategic focus on expanding their customer base and addressing the unique challenges faced by SMEs in accessing credit. By tailoring their offerings, S&P The Credit Risk Rating Software, potentially increasing its market share.

In July 2025, FICO (US) unveiled a new AI-driven credit scoring model that promises to enhance the accuracy of risk assessments while reducing bias. This development underscores FICO's commitment to innovation and ethical practices in credit scoring, which may resonate well with socially conscious consumers and businesses. The introduction of such advanced models could redefine competitive standards in the industry, pushing other players to adapt or risk obsolescence.

As of October 2025, the Credit Risk Rating Software Market is witnessing significant trends such as digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the value of collaboration in enhancing their technological capabilities. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technology integration, and supply chain reliability, as firms strive to meet the complex demands of a rapidly changing financial environment.

Leave a Comment