Growing Focus on Customer Experience

The Credit Management Software Market Industry is witnessing a growing focus on enhancing customer experience. Businesses are recognizing that effective credit management not only involves risk assessment but also maintaining positive relationships with customers. Software solutions that facilitate seamless communication and provide customers with transparent credit terms are gaining traction. This shift is driven by the understanding that satisfied customers are more likely to fulfill their credit obligations. As a result, companies are investing in credit management tools that prioritize user experience and engagement. The emphasis on customer-centric approaches is likely to propel the growth of the Credit Management Software Market Industry as organizations strive to balance risk management with customer satisfaction.

Regulatory Compliance and Risk Management

In the Credit Management Software Market Industry, the increasing emphasis on regulatory compliance is a significant driver. Organizations are compelled to adhere to various financial regulations, which necessitates the implementation of effective credit management solutions. Non-compliance can lead to severe penalties and reputational damage, prompting businesses to invest in software that ensures adherence to legal standards. The market is witnessing a shift towards solutions that not only streamline credit processes but also incorporate compliance features. This trend is particularly evident in sectors such as finance and healthcare, where regulatory scrutiny is intense. As a result, the Credit Management Software Market Industry is likely to see a rise in demand for tools that facilitate compliance and enhance risk management capabilities.

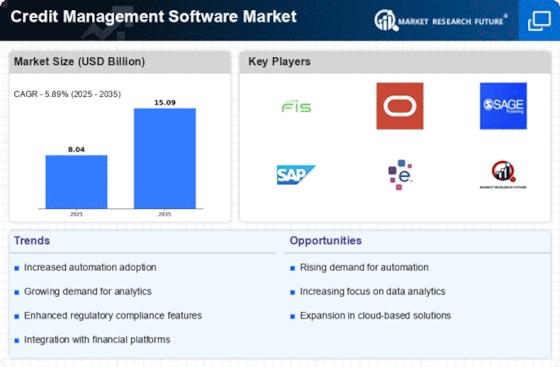

Rising Demand for Efficient Credit Management

The Credit Management Software Market Industry experiences a notable surge in demand as businesses increasingly seek efficient solutions to manage credit risk. Companies are recognizing the importance of maintaining healthy cash flow and minimizing bad debts. According to recent data, organizations that implement robust credit management systems can reduce overdue accounts by up to 30%. This trend is driven by the need for real-time monitoring of credit exposure and the ability to make informed decisions based on accurate data. As businesses expand their operations, the complexity of managing credit increases, thereby propelling the adoption of sophisticated credit management software. The Credit Management Software Market Industry is thus positioned for growth as firms prioritize financial stability and risk mitigation.

Increase in E-commerce and Online Transactions

The rise of e-commerce and online transactions is a significant driver for the Credit Management Software Market Industry. As more businesses transition to digital platforms, the need for effective credit management solutions becomes paramount. E-commerce companies face unique challenges related to credit risk, particularly with new customers and high transaction volumes. Implementing credit management software allows these businesses to assess creditworthiness efficiently and manage risks associated with online sales. Recent statistics indicate that e-commerce sales have surged, leading to an increased demand for credit management solutions that can handle the complexities of online transactions. Consequently, the Credit Management Software Market Industry is poised for growth as businesses adapt to the evolving landscape of digital commerce.

Technological Advancements in Credit Management

Technological advancements play a pivotal role in shaping the Credit Management Software Market Industry. Innovations such as artificial intelligence and machine learning are transforming how credit assessments are conducted. These technologies enable organizations to analyze vast amounts of data quickly, leading to more accurate credit scoring and risk evaluation. Furthermore, the integration of predictive analytics allows businesses to anticipate potential credit issues before they arise. As companies increasingly adopt these advanced technologies, the Credit Management Software Market Industry is expected to expand significantly. The ability to leverage technology for improved decision-making and operational efficiency is becoming a key differentiator in the competitive landscape.