Rising Default Rates

The Credit Insurance Market is significantly influenced by the rising default rates observed in various sectors. As economic conditions fluctuate, businesses face increased risks of insolvency, prompting a greater reliance on credit insurance to protect against potential losses. Recent data suggests that default rates have risen by approximately 15% in certain industries, underscoring the necessity for companies to secure their receivables. This trend indicates a growing awareness among businesses regarding the importance of credit insurance as a risk management tool. Consequently, the demand for credit insurance is expected to escalate, as organizations seek to mitigate the financial impact of defaults and ensure business continuity.

Increased Trade Activities

The Credit Insurance Market is experiencing a surge in demand due to heightened trade activities across various sectors. As businesses expand their operations internationally, the need for credit insurance becomes paramount to mitigate risks associated with non-payment. In 2025, the value of global trade is projected to reach approximately 28 trillion USD, indicating a robust environment for credit insurance providers. This growth in trade activities not only enhances the potential for revenue generation but also necessitates the protection of receivables, thereby driving the credit insurance market forward. Companies are increasingly recognizing the importance of safeguarding their financial interests, which is likely to result in a sustained increase in credit insurance uptake.

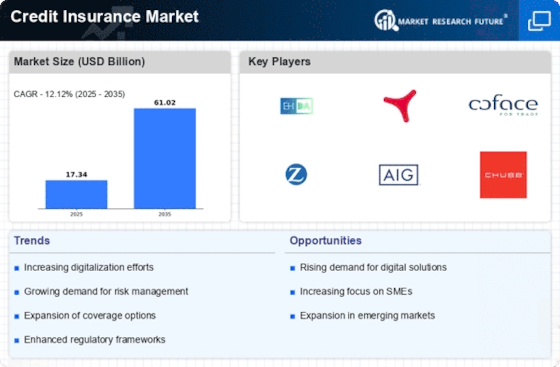

Technological Advancements

The Credit Insurance Market is being transformed by rapid technological advancements that enhance the efficiency and accessibility of credit insurance products. Innovations such as artificial intelligence and big data analytics are enabling insurers to assess risks more accurately and tailor policies to meet specific client needs. In 2025, it is estimated that the adoption of technology in the insurance sector could lead to a 20% reduction in operational costs for providers. This technological integration not only streamlines the underwriting process but also improves customer experience, making credit insurance more appealing to businesses. As technology continues to evolve, it is likely to play a crucial role in shaping the future landscape of the credit insurance market.

Regulatory Changes and Compliance

The Credit Insurance Market is significantly impacted by evolving regulatory frameworks that necessitate compliance from businesses. As governments implement stricter regulations regarding credit risk management, companies are compelled to adopt credit insurance solutions to meet these requirements. In 2025, it is anticipated that regulatory compliance costs could rise by 10% for businesses, prompting them to seek credit insurance as a means of ensuring adherence to legal standards. This trend indicates a growing interdependence between regulatory environments and the credit insurance market, as organizations strive to align their operations with compliance mandates. Consequently, the demand for credit insurance is expected to increase as businesses navigate the complexities of regulatory landscapes.

Growing Awareness of Risk Management

The Credit Insurance Market is witnessing a paradigm shift as businesses increasingly recognize the importance of comprehensive risk management strategies. The growing awareness of potential financial risks associated with trade and credit transactions is driving companies to seek credit insurance as a protective measure. In recent surveys, approximately 70% of businesses indicated that they consider credit insurance essential for safeguarding their financial health. This heightened awareness is likely to lead to a sustained increase in demand for credit insurance products, as organizations prioritize risk mitigation in their operational strategies. The trend suggests that credit insurance will become an integral component of financial planning for businesses across various sectors.