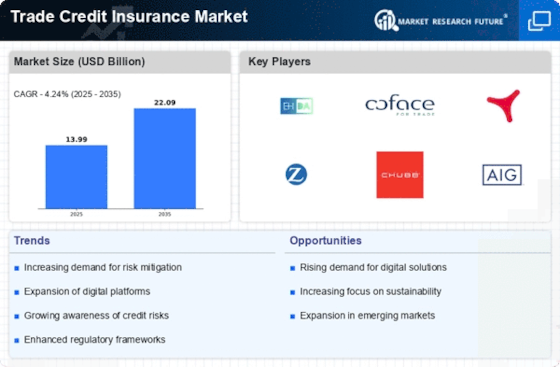

Rising Trade Volumes

The Trade Credit Insurance Market is experiencing growth due to increasing trade volumes across various sectors. As businesses expand their operations internationally, the need for protection against non-payment risks becomes paramount. In 2025, trade volumes are projected to reach unprecedented levels, with estimates suggesting a growth rate of approximately 5% annually. This surge in trade activities necessitates robust credit insurance solutions to safeguard against potential defaults. Consequently, companies are increasingly turning to trade credit insurance as a means to mitigate risks associated with cross-border transactions. The rising trade volumes not only enhance the demand for trade credit insurance but also encourage insurers to innovate and tailor their offerings to meet the evolving needs of businesses engaged in international trade.

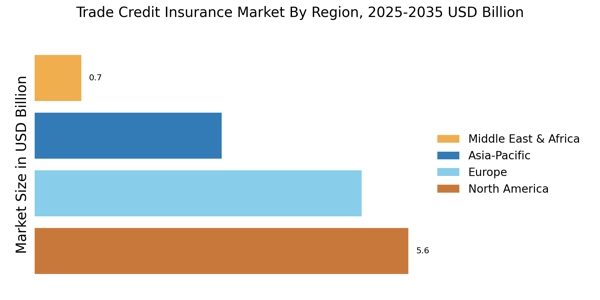

Expansion of Emerging Markets

The Trade Credit Insurance Market is poised for expansion due to the growth of emerging markets. As economies in developing regions continue to evolve, businesses are increasingly engaging in international trade, creating a demand for trade credit insurance. In 2025, emerging markets are expected to account for a significant portion of global trade, with estimates suggesting a growth rate of around 7% annually. This trend presents a lucrative opportunity for trade credit insurers to tap into new customer bases. The expansion of emerging markets not only increases the demand for insurance solutions but also encourages insurers to adapt their offerings to cater to the unique needs of businesses operating in these regions. The potential for growth in these markets is likely to be a key driver for the trade credit insurance industry.

Increased Awareness of Credit Risks

The Trade Credit Insurance Market is witnessing a heightened awareness of credit risks among businesses. As economic conditions fluctuate, companies are becoming more cognizant of the potential financial repercussions of customer defaults. This awareness is driving the demand for trade credit insurance as a proactive measure to safeguard against unforeseen losses. In recent years, surveys indicate that approximately 60% of businesses recognize the importance of credit insurance in their risk management strategies. This trend suggests that organizations are increasingly prioritizing financial security, leading to a more robust market for trade credit insurance. The growing emphasis on credit risk management is likely to propel the industry forward, as businesses seek comprehensive solutions to protect their interests.

Technological Innovations in Underwriting

The Trade Credit Insurance Market is benefiting from technological innovations that enhance underwriting processes. Advanced data analytics and artificial intelligence are being increasingly integrated into risk assessment methodologies, allowing insurers to evaluate creditworthiness more accurately. This technological evolution is streamlining the underwriting process, reducing the time required to issue policies and improving overall efficiency. In 2025, it is anticipated that the adoption of technology in underwriting will increase by approximately 30%, enabling insurers to offer more competitive pricing and tailored solutions. As businesses seek faster and more reliable insurance options, the integration of technology into the trade credit insurance market is likely to drive growth and improve customer satisfaction.

Regulatory Changes Favoring Insurance Solutions

The Trade Credit Insurance Market is influenced by regulatory changes that favor the adoption of insurance solutions. Governments and regulatory bodies are increasingly recognizing the importance of trade credit insurance in promoting economic stability. Recent policy shifts have encouraged businesses to utilize credit insurance as a means to enhance their financial resilience. For instance, certain jurisdictions have introduced incentives for companies that invest in risk management solutions, including trade credit insurance. This regulatory support is expected to bolster the market, as businesses are more likely to seek insurance coverage to comply with evolving regulations. The alignment of regulatory frameworks with the objectives of the trade credit insurance market is likely to create a conducive environment for growth.