Creatinine Test Market Summary

As per Market Research Future analysis, the Creatinine Test Market Size was estimated at 1.207 USD Billion in 2024. The Creatinine Test industry is projected to grow from 1.371 USD Billion in 2025 to 4.936 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 13.66% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Creatinine Test Market is experiencing robust growth driven by technological advancements and increasing health awareness.

- The rising prevalence of kidney diseases is propelling demand for creatinine testing across various demographics.

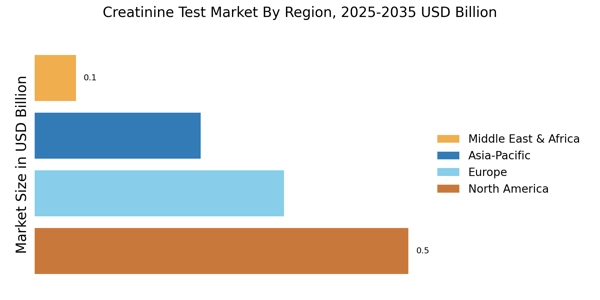

- Technological advancements in diagnostics are enhancing the accuracy and efficiency of creatinine tests, particularly in North America.

- There is a notable shift towards home testing solutions, especially in the Asia-Pacific region, catering to the growing consumer preference for convenience.

- Key market drivers include rising awareness of kidney health and the increasing incidence of diabetes and hypertension, which are significantly influencing market dynamics.

Market Size & Forecast

| 2024 Market Size | 1.207 (USD Billion) |

| 2035 Market Size | 4.936 (USD Billion) |

| CAGR (2025 - 2035) | 13.66% |

Major Players

Abbott Laboratories (US), Roche Diagnostics (CH), Siemens Healthineers (DE), Thermo Fisher Scientific (US), Danaher Corporation (US), Becton Dickinson and Company (US), Ortho Clinical Diagnostics (US), Mindray Medical International Limited (CN)