Market Trends

Key Emerging Trends in the COVID 19 Sample Collection Kits Market

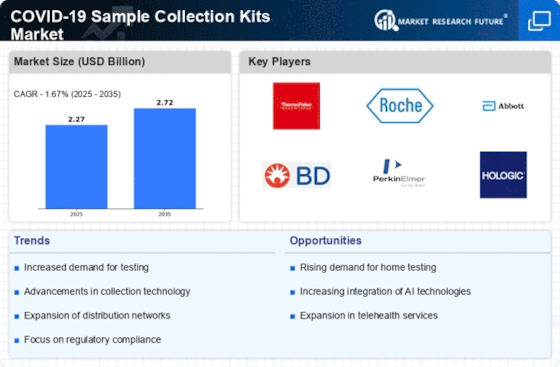

The COVID-19 sample collection kits market has seen a surge because of the universal endeavors to build COVID-19 testing. As testing remains a basic device in dealing with the pandemic, the market has encountered an elevated interest for sample collection kits that empower people to gather specimens for COVID-19 testing effectively and securely. A huge pattern in the market is the rising inclination for locally established testing worked with by COVID-19 sample collection kits. Home testing kits engage people to gather their samples at home, offering comfort and diminishing the risk of infection in crowded testing habitats. This pattern lines up with the more extensive development towards decentralized and open healthcare arrangements. The reconciliation of versatile applications with COVID-19 sample collection kits is turning into an important pattern. Portable applications guide people through the sample collection process, guaranteeing appropriate strategy and working with the consistent transmission of experimental outcomes. This combination improves client experience, smoothes out information management, and advances effective mail among people and healthcare suppliers. The COVID-19 sample collection kits market has confronted difficulties connected with worldwide dispersion. The interest for kits has prompted inventory network disturbances, transportation delays, and calculated difficulties, affecting the convenient appropriation of kits to different locations. These difficulties highlight the requirement for strong store network management in the healthcare area. The market has seen an ascent in the reception of point-of-care testing worked with by sample collection kits. Fast testing, often utilizing sample collection kits with speedy times required to circle back, studies on-the-spot finding, empowering quicker direction and ideal execution of general health measures to control the spread of the virus. The development of new COVID-19 variations has provoked transformations in sample collection kits to guarantee proceeded with adequacy in distinguishing the virus. Makers are closely checking the advancement of the virus and refreshing their kits to address the difficulties presented by variations, stressing the significance of adaptability and responsiveness in the market.

Leave a Comment