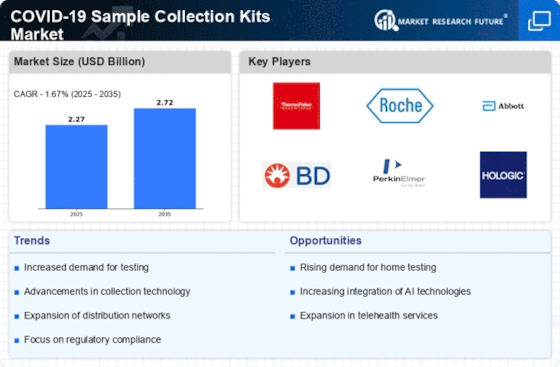

Market Share

COVID 19 Sample Collection Kits Market Share Analysis

An essential procedure includes quick turn of events and administrative endorsement of sample collection kits. Organizations put resources into sped up innovative work to offer imaginative and compact kits for sale to the public quickly. Expedient administrative endorsements upgrade market section, situating organizations as responsive and proactive even with the pandemic. Perceiving the variety of COVID-19 testing techniques, organizations center around creating sample collection kits tailored to different testing modalities. This incorporates kits viable with polymerase chain response (PCR), antigen, and neutralizer tests. Customization guarantees similarity with various lab arrangements, upgrading market importance and seriousness. Catching a huge market share includes zeroing in on worldwide extension procedures. Organizations plan to enter new geological locales, adjusting their marketing and dispersion ways to deal with suit different healthcare scenes and administrative conditions. Guaranteeing availability in both created and creating areas is basic for market strength. Contending on reasonableness is a huge market situating system. Organizations enhance their assembling cycles to offer sample collection kits at competitive costs without compromising quality. Smart arrangements appeal to a more extensive scope of healthcare offices and testing focuses, reinforcing market importance. Productive organizations center around creating sample collection kits that take care of different sample types, including nasal swabs, oral swabs, saliva, and the sky is the limit from there. Offering flexibility in sample collection upgrades the versatility of kits across various testing situations, tending to the developing requirements of healthcare suppliers. In the advanced stages, organizations focus on giving web-based answers for pack requesting and following. Laying out easy to use online stages and versatile applications smoothes out the acquisition interaction for healthcare offices and empowers proficient following of unit shipments. Computerized arrangements upgrade comfort and add to market separation.

Leave a Comment