Increasing Demand from End-Use Industries

The Global Corrosion Resistant Alloy Market Industry is experiencing heightened demand from various end-use sectors, particularly in oil and gas, aerospace, and marine applications. These industries require materials that can withstand harsh environments, leading to a projected market value of 9.83 USD Billion in 2024. The need for durable and reliable materials is underscored by the increasing focus on safety and efficiency in operations. For instance, the aerospace sector utilizes corrosion-resistant alloys to enhance the longevity and performance of aircraft components, thereby driving the market's growth.

Regulatory Support for Corrosion Management

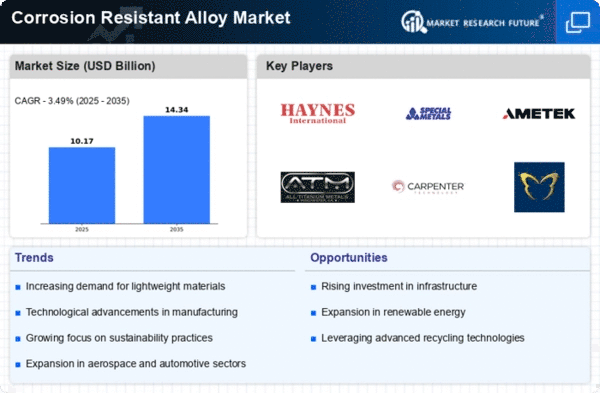

Government regulations aimed at corrosion management are playing a crucial role in shaping the Global Corrosion Resistant Alloy Market Industry. Policies that promote the use of corrosion-resistant materials in infrastructure projects are becoming increasingly prevalent. For example, initiatives to improve the longevity of bridges and pipelines are driving demand for these alloys. The regulatory framework encourages industries to adopt materials that minimize maintenance costs and enhance safety. This trend is likely to contribute to the market's growth, with projections indicating a rise to 14.3 USD Billion by 2035.

Technological Advancements in Alloy Production

Innovations in alloy production techniques are significantly influencing the Global Corrosion Resistant Alloy Market Industry. Advanced manufacturing processes, such as additive manufacturing and precision casting, enable the creation of alloys with superior properties. These advancements not only improve the performance of corrosion-resistant alloys but also reduce production costs. As a result, manufacturers can offer more competitive pricing, potentially expanding their market share. The ongoing research and development efforts in metallurgy are expected to further enhance the quality and application scope of these alloys, thereby fostering market growth.

Rising Investment in Infrastructure Development

Investment in infrastructure development is a key driver for the Global Corrosion Resistant Alloy Market Industry. Governments and private sectors are allocating substantial funds towards building and upgrading infrastructure, including transportation, energy, and water systems. The use of corrosion-resistant alloys in these projects is essential for ensuring durability and reducing maintenance costs over time. As infrastructure projects expand globally, the demand for these alloys is anticipated to rise. This trend is expected to sustain a compound annual growth rate of 3.49% from 2025 to 2035, reflecting the growing reliance on advanced materials.

Growing Awareness of Environmental Sustainability

The Global Corrosion Resistant Alloy Market Industry is also benefiting from a growing awareness of environmental sustainability. Industries are increasingly recognizing the importance of using materials that reduce environmental impact. Corrosion-resistant alloys, known for their durability and longevity, contribute to sustainability by minimizing waste and the need for frequent replacements. This shift towards eco-friendly practices is prompting manufacturers to innovate and develop alloys that align with sustainability goals. As a result, the market is expected to witness a steady growth trajectory, supported by the increasing emphasis on responsible manufacturing.