North America : Established Market with Growth Potential

The North American anti-corrosion coating market is projected to reach $10.96 billion by 2025, driven by increasing infrastructure investments and stringent environmental regulations. The demand for protective coatings in sectors like automotive, marine, and construction is on the rise, fueled by a focus on sustainability and durability. Regulatory frameworks are pushing for eco-friendly products, enhancing market growth.

Leading countries in this region include the US and Canada, where major players like PPG Industries and Sherwin-Williams dominate the landscape. The competitive environment is characterized by innovation and strategic partnerships among key manufacturers. The presence of established companies ensures a robust supply chain, catering to diverse industrial needs.

Europe : Innovative Solutions and Sustainability Focus

Europe's anti-corrosion coating market is expected to reach €9.8 billion by 2025, driven by stringent regulations and a strong emphasis on sustainability. The European Union's directives on environmental protection are catalyzing the demand for eco-friendly coatings, which are increasingly favored in construction and automotive sectors. This regulatory landscape is fostering innovation in product development, enhancing market growth.

Germany, France, and the UK are leading countries in this market, with key players like BASF and AkzoNobel at the forefront. The competitive landscape is marked by a focus on R&D and the introduction of advanced coating technologies. The presence of these major companies ensures a diverse range of products, catering to various industrial applications.

Asia-Pacific : Rapid Growth and Market Leadership

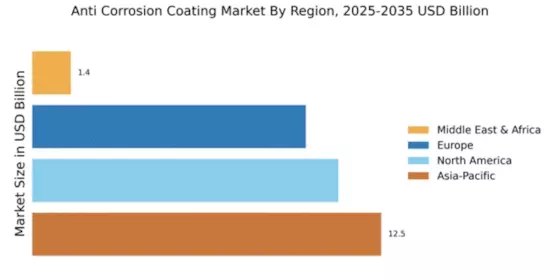

The Asia-Pacific anti-corrosion coating market is projected to dominate with a market size of $12.5 billion by 2025, driven by rapid industrialization and urbanization. Countries like China and India are experiencing significant growth in infrastructure projects, leading to increased demand for protective coatings. The region's focus on sustainable development is also pushing for innovative coating solutions that meet environmental standards.

China, Japan, and India are the leading countries in this market, with major players like Nippon Paint and Kansai Paint driving competition. The presence of these companies fosters a dynamic market environment, characterized by technological advancements and strategic collaborations. The competitive landscape is further enhanced by the growing emphasis on quality and performance in coating products.

Middle East and Africa : Emerging Market with Growth Opportunities

The Middle East and Africa anti-corrosion coating market is expected to reach $1.38 billion by 2025, driven by increasing investments in infrastructure and oil & gas sectors. The region's economic diversification efforts are creating demand for protective coatings in various industries, including construction and manufacturing. Regulatory initiatives aimed at enhancing product quality are also contributing to market growth.

Leading countries in this region include the UAE and South Africa, where key players like Hempel and Jotun are establishing a strong presence. The competitive landscape is evolving, with local manufacturers emerging alongside established global brands. This dynamic environment presents significant opportunities for growth and innovation in the anti-corrosion coating sector.