Growth in the Oil and Gas Sector

The oil and gas sector is experiencing a resurgence, which appears to be positively impacting the Corrosion Protective Coatings Market (CPC) Market. As exploration and production activities ramp up, the need for effective corrosion protection in pipelines, storage tanks, and offshore platforms becomes increasingly critical. Corrosion can lead to catastrophic failures and environmental disasters, making CPCs essential for operational integrity. Recent reports suggest that the oil and gas industry is projected to invest over USD 1 trillion in infrastructure by 2030, which is likely to drive substantial demand for corrosion protective solutions. This investment trend underscores the importance of CPCs in ensuring the longevity and safety of critical assets.

Rising Infrastructure Development

The ongoing expansion of infrastructure projects across various sectors, including transportation, energy, and construction, appears to be a primary driver for the Corrosion Protective Coatings Market (CPC) Market. As nations invest in modernizing their infrastructure, the demand for durable and long-lasting materials increases. Corrosion protective coatings are essential in safeguarding structures from environmental degradation, thereby extending their lifespan. According to recent estimates, the infrastructure sector is projected to witness a compound annual growth rate of approximately 4.5% over the next few years. This growth is likely to bolster the demand for CPCs, as they play a crucial role in protecting assets from corrosion-related failures, which can lead to significant economic losses.

Stringent Environmental Regulations

The implementation of stringent environmental regulations is emerging as a significant driver for the Corrosion Protective Coatings Market (CPC) Market. Governments and regulatory bodies are increasingly mandating the use of eco-friendly coatings that minimize environmental impact. This shift is prompting manufacturers to innovate and develop low-VOC (volatile organic compounds) and water-based coatings that comply with these regulations. As industries adapt to these requirements, the demand for compliant CPCs is expected to grow. Market forecasts indicate that the eco-friendly coatings segment could account for over 30% of the total CPC market by 2027, reflecting the industry's response to regulatory pressures and sustainability goals.

Increased Awareness of Corrosion Prevention

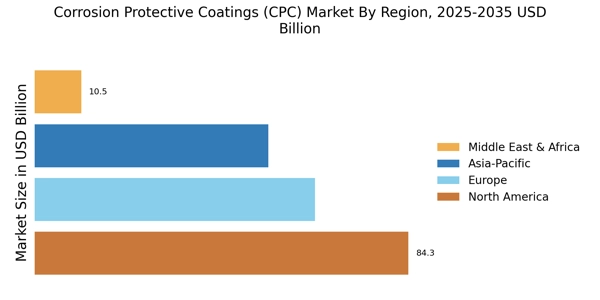

There is a growing recognition of the detrimental effects of corrosion on various industries, which seems to be driving the Corrosion Protective Coatings Market (CPC) Market. Industries such as oil and gas, marine, and manufacturing are increasingly aware of the costs associated with corrosion, including maintenance and replacement expenses. This awareness has led to a heightened focus on preventive measures, including the application of CPCs. Market data indicates that The Corrosion Protective Coatings Market (CPC) is expected to reach USD 30 billion by 2026, with CPCs constituting a substantial portion of this growth. The emphasis on proactive corrosion management strategies is likely to further propel the demand for these coatings.

Technological Innovations in Coating Formulations

Advancements in coating technologies are significantly influencing the Corrosion Protective Coatings Market (CPC) Market. Innovations such as the development of high-performance coatings with enhanced resistance to extreme conditions are becoming increasingly prevalent. These new formulations often incorporate nanotechnology and advanced polymers, which improve adhesion and durability. As industries seek to optimize their operations and reduce maintenance costs, the demand for these innovative coatings is likely to rise. Recent market analyses suggest that the introduction of smart coatings, which can provide real-time monitoring of corrosion, may further transform the CPC landscape, offering new opportunities for growth and application.