Regulatory Support and Standardization

Regulatory support and the establishment of standardized protocols for coronary pressure monitoring are emerging as crucial drivers for the Coronary Pressure Monitors Market. Regulatory bodies are increasingly recognizing the importance of these devices in managing cardiovascular health, leading to streamlined approval processes and enhanced market access. The introduction of guidelines that promote the use of coronary pressure monitors in clinical practice may further stimulate demand. Additionally, standardization efforts aimed at ensuring the accuracy and reliability of these devices could enhance consumer confidence and adoption rates. As regulatory frameworks evolve, they are likely to create a conducive environment for market growth, encouraging manufacturers to innovate and expand their product offerings.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare strategies is likely to significantly influence the Coronary Pressure Monitors Market. Healthcare systems worldwide are increasingly prioritizing early detection and management of cardiovascular conditions to reduce long-term healthcare costs. This shift towards preventive measures encourages the adoption of coronary pressure monitors, as they enable healthcare professionals to identify potential issues before they escalate. Market data indicates that investments in preventive healthcare initiatives have surged, with many countries allocating substantial budgets to enhance screening and monitoring programs. This trend suggests a favorable environment for the growth of the coronary pressure monitors market, as healthcare providers seek to integrate these devices into routine check-ups and health assessments.

Rising Incidence of Cardiovascular Diseases

The escalating prevalence of cardiovascular diseases globally serves as a significant driver for the Coronary Pressure Monitors Market. According to recent health statistics, cardiovascular diseases account for a substantial proportion of global mortality rates, necessitating effective monitoring solutions. The increasing number of patients requiring regular monitoring of coronary pressure is likely to boost the demand for these devices. Furthermore, the aging population, which is more susceptible to heart-related ailments, contributes to this rising trend. It is estimated that by 2030, the number of individuals aged 60 and above will reach 1.4 billion, further intensifying the need for reliable monitoring solutions. Consequently, this growing patient demographic is expected to drive market expansion, as healthcare providers seek to implement advanced monitoring technologies.

Growing Awareness and Education on Heart Health

The rising awareness and education regarding heart health among the general population appear to be a significant driver for the Coronary Pressure Monitors Market. Public health campaigns and educational initiatives aimed at promoting cardiovascular health are increasingly prevalent, leading to a more informed consumer base. This heightened awareness encourages individuals to seek regular monitoring of their heart health, thereby driving demand for coronary pressure monitors. Market Research Future indicates that consumers are becoming more proactive in managing their health, with many individuals now prioritizing regular check-ups and monitoring. This trend suggests a potential increase in the adoption of coronary pressure monitors, as individuals recognize the importance of early detection and management of cardiovascular issues.

Technological Advancements in Monitoring Devices

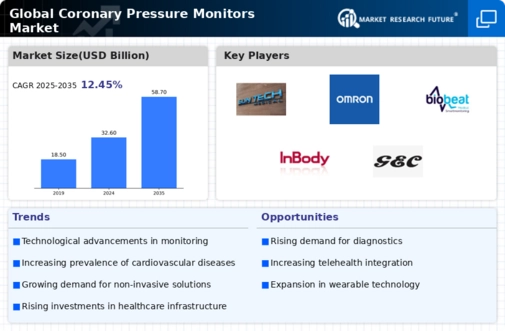

The emergence of advanced technologies in the field of medical devices appears to be a pivotal driver for the Coronary Pressure Monitors Market. Innovations such as wireless connectivity, real-time data analytics, and miniaturization of devices enhance the functionality and usability of coronary pressure monitors. These advancements facilitate remote patient monitoring, which is increasingly favored in contemporary healthcare settings. The integration of artificial intelligence and machine learning algorithms into these devices may further improve diagnostic accuracy and patient outcomes. As a result, the market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate of over 8% in the coming years. This trend indicates a robust demand for technologically advanced coronary pressure monitors, thereby propelling the market forward.