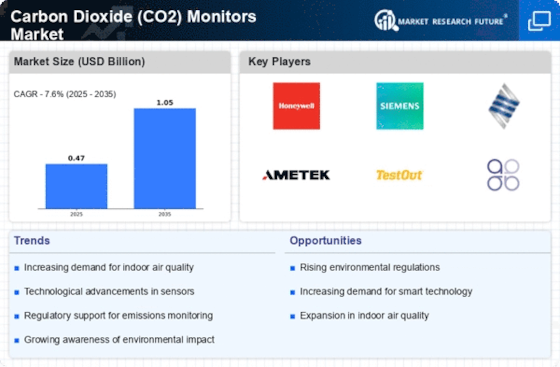

Growing Adoption in Commercial Spaces

The growing adoption of Carbon Dioxide (CO2) monitors in commercial spaces is a notable driver for the Carbon Dioxide (CO2) Monitors Market. Businesses are increasingly recognizing the importance of maintaining optimal indoor air quality to enhance employee productivity and customer satisfaction. In sectors such as hospitality, retail, and office environments, the implementation of CO2 monitoring systems is becoming standard practice. Research indicates that improved air quality can lead to higher productivity levels and reduced absenteeism among employees. As a result, companies are investing in CO2 monitors to create healthier work environments. This trend is expected to continue, as more organizations prioritize employee well-being and seek to comply with emerging regulations regarding indoor air quality.

Government Initiatives and Regulations

Government initiatives and regulations significantly influence the Carbon Dioxide (CO2) Monitors Market. Many governments are implementing stringent regulations aimed at improving air quality and reducing greenhouse gas emissions. These regulations often mandate the use of CO2 monitoring devices in various sectors, including industrial, commercial, and residential settings. For instance, regulations may require businesses to monitor indoor air quality to ensure compliance with health and safety standards. This regulatory landscape creates a favorable environment for the growth of the CO2 monitor market, as organizations seek to adhere to legal requirements. Additionally, government incentives for adopting energy-efficient technologies further stimulate market demand, as businesses and consumers are encouraged to invest in CO2 monitoring solutions.

Increasing Awareness of Health Impacts

The rising awareness regarding the health impacts of poor air quality is a crucial driver for the Carbon Dioxide (CO2) Monitors Market. As individuals become more informed about the potential health risks associated with elevated CO2 levels, there is a growing demand for monitoring solutions. Studies indicate that high CO2 concentrations can lead to various health issues, including headaches, dizziness, and impaired cognitive function. Consequently, consumers and businesses are increasingly investing in CO2 monitors to ensure a safe indoor environment. This trend is particularly evident in educational institutions and workplaces, where maintaining optimal air quality is essential for productivity and well-being. The heightened focus on health and safety is likely to propel the market forward, as more entities recognize the importance of monitoring CO2 levels to mitigate health risks.

Rising Demand for Smart Home Solutions

The rising demand for smart home solutions is significantly impacting the Carbon Dioxide (CO2) Monitors Market. As consumers increasingly seek to integrate smart technology into their homes, the demand for smart CO2 monitors is on the rise. These devices not only monitor CO2 levels but also connect to home automation systems, allowing users to receive real-time alerts and control ventilation systems remotely. The convenience and efficiency offered by smart CO2 monitors appeal to tech-savvy consumers who prioritize health and comfort in their living spaces. Market data suggests that the smart home segment is expected to grow substantially, further driving the demand for CO2 monitoring solutions. This trend indicates a shift towards more interconnected and intelligent home environments, where air quality management is seamlessly integrated into daily life.

Technological Advancements in Monitoring Devices

Technological advancements play a pivotal role in shaping the Carbon Dioxide (CO2) Monitors Market. Innovations in sensor technology have led to the development of more accurate, reliable, and user-friendly CO2 monitoring devices. These advancements enable real-time monitoring and data analysis, which are essential for effective air quality management. Moreover, the integration of IoT capabilities allows for remote monitoring and alerts, enhancing user convenience. The market has witnessed a surge in demand for portable and compact CO2 monitors, catering to both residential and commercial applications. As technology continues to evolve, it is anticipated that the market will experience further growth, driven by the introduction of advanced features and functionalities that meet the diverse needs of consumers.