Sustainability Trends

The growing emphasis on sustainability and environmentally friendly practices is influencing the Corn Flour Market. Consumers are increasingly inclined towards products that are produced with minimal environmental impact. Corn flour, often derived from crops that require less water and are more sustainable than other grains, aligns well with this trend. Furthermore, the rise of organic farming practices is likely to enhance the appeal of corn flour, as consumers seek non-GMO and organic options. Market data indicates a steady increase in the sales of organic corn flour, reflecting a shift in consumer preferences. This focus on sustainability may drive manufacturers to adopt eco-friendly practices, thereby fostering growth within the Corn Flour Market.

Rising Health Consciousness

The increasing awareness regarding health and nutrition among consumers appears to be a pivotal driver for the Corn Flour Market. As individuals seek healthier dietary options, corn flour, known for its gluten-free properties, is gaining traction. This shift is reflected in market data, indicating a notable rise in the consumption of gluten-free products, with corn flour being a preferred choice. The health benefits associated with corn flour, such as its high fiber content and essential nutrients, further enhance its appeal. Consequently, manufacturers are likely to innovate and diversify their product offerings to cater to this health-conscious demographic, thereby propelling the growth of the Corn Flour Market.

Expansion of Food Applications

The versatility of corn flour in various culinary applications is a significant driver for the Corn Flour Market. It is utilized in a myriad of products, ranging from baked goods to sauces and snacks. This adaptability not only broadens the consumer base but also encourages food manufacturers to incorporate corn flour into their recipes. Market data suggests that the demand for corn flour in processed foods is on the rise, as it enhances texture and flavor. Additionally, the trend towards homemade and artisanal food products is likely to further stimulate interest in corn flour, as consumers seek quality ingredients. This expansion of food applications is expected to play a crucial role in the growth trajectory of the Corn Flour Market.

Cultural and Regional Preferences

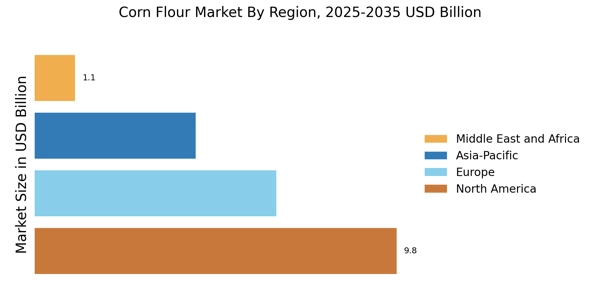

Cultural influences and regional preferences play a crucial role in shaping the Corn Flour Market. In many regions, corn flour is a staple ingredient, integral to traditional dishes. This cultural significance drives consistent demand, as consumers seek authentic flavors and textures in their food. Market data reveals that regions with a strong culinary heritage involving corn flour are witnessing stable growth in its consumption. Additionally, the globalization of food trends is likely to introduce corn flour to new markets, expanding its reach. As culinary diversity continues to evolve, the Corn Flour Market may experience increased interest from consumers eager to explore different cuisines, thereby enhancing its market potential.

Technological Advancements in Production

Technological innovations in the production and processing of corn flour are emerging as a key driver for the Corn Flour Market. Advances in milling technology and processing techniques are enhancing the quality and efficiency of corn flour production. These improvements not only reduce production costs but also ensure a consistent product that meets consumer expectations. Market data indicates that manufacturers adopting modern technologies are likely to gain a competitive edge, as they can offer superior products at competitive prices. Furthermore, the integration of automation in production processes may lead to increased output, catering to the rising demand for corn flour. This focus on technological advancements is expected to significantly influence the growth of the Corn Flour Market.