Increased Competition

The Global Core Banking Solution Market Industry is characterized by heightened competition among financial institutions. As new entrants, including fintech companies, disrupt traditional banking models, established banks are compelled to innovate and enhance their core banking solutions. This competitive landscape drives banks to adopt more agile and customer-centric systems, enabling them to respond swiftly to market changes and customer demands. The need to remain competitive is likely to propel investments in core banking technology, contributing to the market's growth trajectory. With a projected market size of 82.8 USD Billion by 2035, the competitive dynamics within the industry are expected to intensify.

Regulatory Compliance

The Global Core Banking Solution Market Industry is significantly influenced by the need for regulatory compliance. Financial institutions are required to adhere to stringent regulations regarding data security, anti-money laundering, and customer privacy. As regulations evolve, banks are compelled to upgrade their core banking systems to ensure compliance, which often involves substantial investments in technology. This necessity for compliance drives demand for advanced core banking solutions that can provide real-time reporting and analytics. Consequently, the market is anticipated to grow at a compound annual growth rate of 14.52% from 2025 to 2035, reflecting the increasing importance of regulatory adherence in banking.

Market Growth Projections

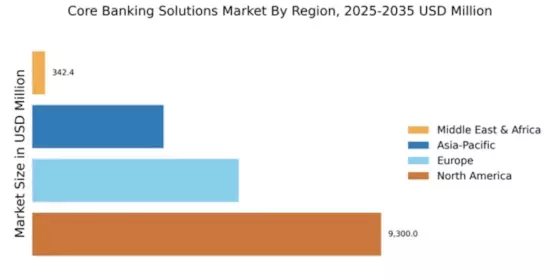

The Global Core Banking Solution Market Industry is projected to experience substantial growth over the next decade. With a market size of 18.6 USD Billion in 2024, the industry is expected to expand significantly, reaching 82.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 14.52% from 2025 to 2035. Such projections indicate a robust demand for core banking solutions as financial institutions increasingly seek to modernize their operations and enhance customer experiences. The anticipated growth reflects the ongoing transformation within the banking sector, driven by technological advancements and changing consumer preferences.

Technological Advancements

The Global Core Banking Solution Market Industry is currently experiencing rapid technological advancements that enhance banking operations. Innovations such as artificial intelligence, machine learning, and blockchain are being integrated into core banking systems, improving efficiency and customer experience. For instance, AI-driven chatbots are streamlining customer service, while blockchain technology is enhancing transaction security. As banks adopt these technologies, they are likely to see increased operational efficiency and reduced costs. This trend is expected to contribute to the market's growth, with projections indicating a market size of 18.6 USD Billion in 2024 and a substantial increase to 82.8 USD Billion by 2035.

Customer-Centric Innovations

The Global Core Banking Solution Market Industry is increasingly focused on customer-centric innovations. Financial institutions are recognizing the importance of tailoring their services to meet the evolving needs of customers. This shift is prompting banks to invest in core banking solutions that offer personalized services, such as customized loan products and targeted marketing campaigns. By leveraging data analytics and customer insights, banks can enhance customer engagement and satisfaction. This trend is likely to drive growth in the market, as banks that prioritize customer-centric innovations are better positioned to thrive in a competitive landscape.

Growing Demand for Digital Banking

The Global Core Banking Solution Market Industry is witnessing a growing demand for digital banking services. As consumers increasingly prefer online and mobile banking solutions, financial institutions are compelled to enhance their core banking systems to support these digital channels. This shift towards digital banking is driven by the need for convenience, speed, and accessibility. Banks that successfully implement robust digital banking solutions are likely to attract and retain customers, thereby increasing their market share. The projected market size of 18.6 USD Billion in 2024 underscores the urgency for banks to adapt to this digital transformation, with expectations of continued growth in the coming years.