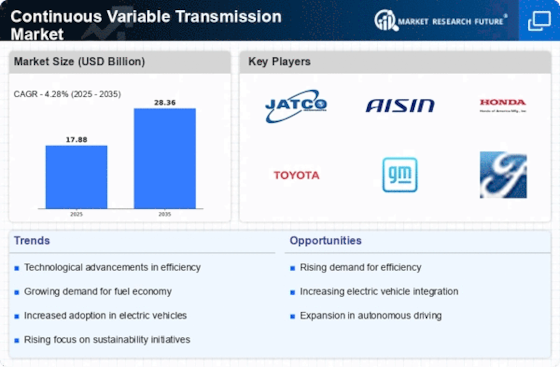

Top Industry Leaders in the Continuous variable transmission Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Continuous Variable Transmission industry are:

JATCO Aisin AW,

Honda,

Fuji Heavy Industries,

Company five,

Punch,

Wanliyang,

Jiangsu & Rongda,

Fallbrook,

Torotrak,

CVTCorp,

Navigating the CVT Road: A Look at the Competitive Landscape

The continuously variable transmission (CVT) market is shifting gears, driven by factors like rising fuel costs, increased focus on fuel efficiency, and growing demand for hybrid and electric vehicles. In this dynamic landscape, key players are employing diverse strategies to gain a competitive edge.

Giants in the Arena: Leading established players like Jatco, Bosch, and ZF Friedrichshafen hold significant market share due to their strong track record, diverse product portfolios, and established relationships with major automakers. These companies continuously invest in research and development, focusing on improving CVT efficiency, performance, and durability. Bosch, for instance, has ventured into hybrid CVT development, while ZF boasts advanced toroidal CVTs with wider gear ratios.

The Challenger's Rise: Emerging players like Aisin AW and Magna PT are also making their mark. Aisin AW, known for its expertise in automatic transmissions, is actively pushing its CVT technology, leveraging its strong presence in Asia. Magna PT, on the other hand, caters to niche markets with specialized CVTs for powersports and off-road vehicles. These players capitalize on their agility and flexibility to offer customized solutions and cater to specific needs.

Beyond Gears: Strategic Maneuvers: Competitive strategies go beyond product development. Several key players are pursuing:

Vertical Integration: Companies like Jatco are integrating key components like pulleys and belts into their production to control quality and optimize costs.

Regional Expansion: Established players are venturing into emerging markets like China and India, where demand for fuel-efficient vehicles is surging. Aisin AW's focus on Asia exemplifies this trend.

Partnerships and Collaborations: Companies are joining forces to leverage each other's strengths. For instance, Bosch and Hyundai collaborated to develop a dual-clutch CVT for hybrid vehicles.

Shifting Trends: The Road Ahead: New and emerging trends are shaping the CVT landscape:

Hybrid Integration: CVTs are increasingly paired with hybrid powertrains, offering exceptional fuel economy and driving performance. Major automakers like Toyota and Honda are leading the charge in this segment.

Electrification: As the electric vehicle market matures, adoption of CVTs within EV powertrains is expected to rise, particularly for range-extender applications. Companies like Aisin AW are actively developing EV-specific CVTs.

Material Advancements: Research on novel materials like high-strength polymers and advanced lubricants is ongoing, promising lighter, more efficient CVTs in the future.

The Big Picture: Competitive Scenario:

The CVT market is a fiercely competitive space, with established players battling emerging challengers. Success hinges on innovation, strategic partnerships, and adapting to evolving trends like hybrid integration and electrification. While established players enjoy an initial advantage, their dominance will be challenged by agile new entrants offering niche solutions and customized approaches. Ultimately, the companies that demonstrate adaptability, embrace technological advancements, and cater to diverse market needs will secure pole position in the race for CVT market leadership.

Latest Company Updates:

JATCO Aisin AW:

- December 2023: Announced a new 9-speed CVT with improved fuel efficiency and performance for hybrid and electric vehicles. (Source: JATCO press release)

Honda:

- August 2023: Unveiled a new hybrid vehicle concept featuring a high-efficiency CVT with integrated electric motor. (Source: Honda press release)

Wanliyang (Wanliyang Transmission Co., Ltd):

- September 2023: Launched a new generation of CVTs for passenger cars with improved fuel economy and performance. (Source: Wanliyang press release)

Fallbrook Technologies:

- October 2023: Announced a licensing agreement with a major Chinese OEM to use its Continuously Variable Hydrostatic Transmission (CVHT) technology. (Source: Fallbrook press release)