Growing Awareness of Energy Efficiency

The Consumer IoT Market is increasingly shaped by a growing awareness of energy efficiency among consumers. As individuals become more environmentally conscious, there is a rising demand for smart devices that can monitor and optimize energy usage. For instance, smart thermostats and energy management systems are gaining popularity, as they allow users to track their energy consumption and reduce waste. According to recent estimates, energy-efficient IoT devices could potentially reduce household energy consumption by up to 30%. This trend not only appeals to eco-conscious consumers but also aligns with governmental initiatives aimed at promoting sustainability. As a result, manufacturers are focusing on developing energy-efficient solutions, further driving growth in the Consumer IoT Market.

Rising Consumer Demand for Smart Devices

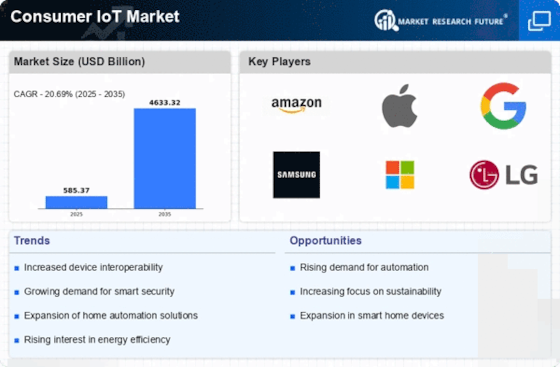

The Consumer IoT Market experiences a notable surge in consumer demand for smart devices, driven by the increasing desire for convenience and automation in daily life. As of 2025, it is estimated that the number of connected devices per household has reached an average of 25, reflecting a growing trend towards smart home integration. This demand is not limited to traditional devices; wearables and health monitoring gadgets are also gaining traction. The proliferation of smartphones and tablets further facilitates the adoption of IoT devices, as consumers seek seamless connectivity and control over their environments. Consequently, manufacturers are compelled to innovate and diversify their product offerings to meet these evolving consumer preferences, thereby propelling the growth of the Consumer IoT Market.

Advancements in Connectivity Technologies

The Consumer IoT Market is significantly influenced by advancements in connectivity technologies, such as 5G and Wi-Fi 6. These technologies enhance the performance and reliability of IoT devices, enabling faster data transmission and improved user experiences. As of 2025, the deployment of 5G networks is expected to cover a substantial portion of urban areas, facilitating the seamless integration of IoT devices into everyday life. This enhanced connectivity allows for real-time data processing and communication, which is crucial for applications in smart homes, healthcare, and industrial automation. The ability to connect multiple devices simultaneously without latency issues is likely to drive further adoption of IoT solutions, thereby expanding the Consumer IoT Market.

Integration of Health and Wellness Solutions

The Consumer IoT Market is witnessing a significant integration of health and wellness solutions, reflecting a broader trend towards personal health management. Wearable devices, such as fitness trackers and smartwatches, are increasingly being adopted by consumers seeking to monitor their health metrics. As of 2025, the market for health-related IoT devices is projected to grow substantially, driven by the rising prevalence of chronic diseases and the need for preventive healthcare. These devices not only provide real-time health data but also facilitate communication with healthcare providers, enhancing patient engagement. The convergence of technology and healthcare is likely to create new opportunities within the Consumer IoT Market, as consumers prioritize their health and well-being.

Increased Investment in Smart City Initiatives

The Consumer IoT Market is positively impacted by increased investment in smart city initiatives, which aim to enhance urban living through technology. Governments and municipalities are allocating substantial resources to develop infrastructure that supports IoT applications, such as smart lighting, waste management, and traffic monitoring. As of 2025, it is anticipated that investments in smart city projects will exceed billions of dollars, creating a robust ecosystem for IoT solutions. This trend not only improves the quality of life for residents but also drives demand for consumer-oriented IoT devices that integrate with smart city infrastructure. The collaboration between public and private sectors is likely to foster innovation and accelerate the growth of the Consumer IoT Market.