Growing Importance of Data Privacy

Data privacy has emerged as a significant concern within the iot consumer-electronics market. As more devices become interconnected, the potential for data breaches increases, prompting consumers to prioritize security features. Manufacturers are responding by implementing robust security measures and transparent data handling practices. Recent surveys indicate that over 60% of consumers are willing to pay a premium for devices that offer enhanced data protection. This growing emphasis on privacy is likely to influence purchasing decisions, shaping the competitive landscape of the iot consumer-electronics market as companies strive to build trust with consumers.

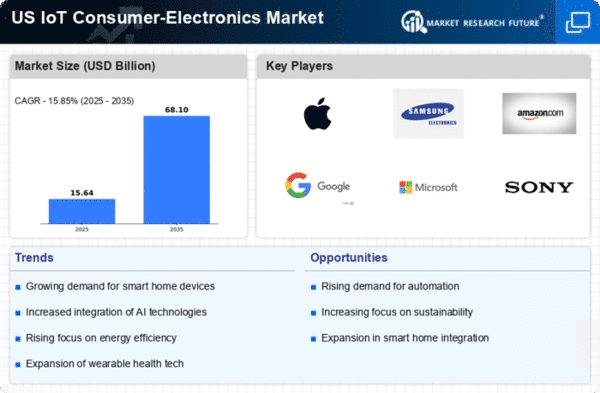

Increased Focus on Energy Efficiency

Energy efficiency has become a critical driver in the iot consumer-electronics market. With rising energy costs and growing environmental concerns, consumers are increasingly seeking devices that minimize energy consumption. Many manufacturers are responding by developing smart appliances and gadgets that optimize energy use, thereby appealing to eco-conscious consumers. Reports indicate that energy-efficient devices can reduce energy consumption by up to 30%, making them attractive options for households. This focus on sustainability is likely to shape product offerings in the iot consumer-electronics market, as companies strive to meet consumer expectations while adhering to regulatory standards.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into consumer electronics is transforming the iot consumer-electronics market. AI technologies enable devices to learn from user behavior, providing personalized experiences and enhancing functionality. For instance, smart home systems can adapt to individual preferences, optimizing energy use and improving security. As AI capabilities continue to evolve, they are expected to play a pivotal role in the development of new products and services within the iot consumer-electronics market. This trend not only enhances user engagement but also drives innovation, as companies seek to leverage AI to differentiate their offerings.

Rising Consumer Demand for Smart Devices

The IoT Consumer-Electronics Market is experiencing a notable surge in consumer demand for smart devices. This trend is driven by the increasing integration of technology into daily life, with consumers seeking convenience and enhanced functionality. According to recent data, approximately 70% of households in the US own at least one smart device, indicating a strong market presence. The proliferation of smart home products, such as smart speakers, thermostats, and security systems, reflects this growing interest. As consumers become more accustomed to the benefits of interconnected devices, the demand for innovative solutions in the iot consumer-electronics market is likely to escalate, pushing manufacturers to develop more advanced and user-friendly products.

Advancements in Connectivity Technologies

The iot consumer-electronics market is significantly influenced by advancements in connectivity technologies. Innovations such as 5G networks and Wi-Fi 6 are enhancing the performance and reliability of smart devices. These technologies enable faster data transmission and improved connectivity, which are crucial for the seamless operation of IoT devices. As of November 2025, it is estimated that 5G adoption in the US has reached around 50%, facilitating the growth of the iot consumer-electronics market. Enhanced connectivity not only improves user experience but also encourages the development of new applications and services, further driving market expansion.