Technological Advancements

Technological innovations are reshaping the Construction Utility Vehicles Market, enhancing vehicle performance and efficiency. The integration of advanced technologies such as telematics, GPS, and automation is becoming increasingly prevalent. These technologies not only improve operational efficiency but also reduce labor costs and enhance safety on construction sites. For example, the adoption of telematics systems allows for real-time monitoring of vehicle performance, leading to better maintenance and reduced downtime. As these technologies continue to evolve, they are expected to attract more investments into the Construction Utility Vehicles Market, as companies seek to leverage these advancements for competitive advantage. The potential for increased productivity and reduced operational costs makes this driver particularly compelling.

Rising Infrastructure Investments

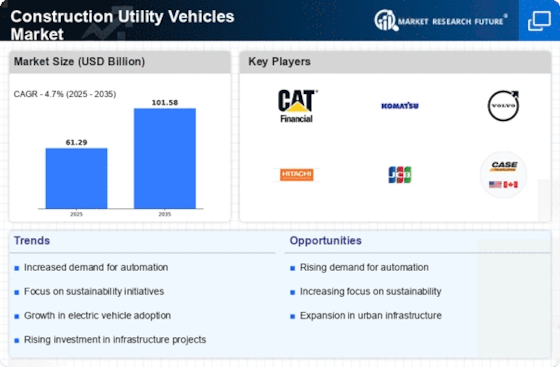

The Construction Utility Vehicles Market is experiencing a surge in demand due to increased investments in infrastructure projects. Governments and private sectors are allocating substantial budgets for the development of roads, bridges, and public facilities. For instance, recent reports indicate that infrastructure spending is projected to reach trillions of dollars over the next decade. This trend is likely to drive the need for construction utility vehicles, which are essential for efficient project execution. As urbanization continues to expand, the requirement for robust and versatile vehicles becomes more pronounced, thereby propelling the market forward. The Construction Utility Vehicles Market stands to benefit significantly from these investments, as they are integral to the successful completion of large-scale construction projects.

Urbanization and Population Growth

Urbanization and population growth are significant drivers of the Construction Utility Vehicles Market. As more people migrate to urban areas, the demand for housing, infrastructure, and public services escalates. This rapid urban development necessitates the use of construction utility vehicles to facilitate various projects, from residential buildings to commercial complexes. Recent statistics indicate that urban populations are projected to increase substantially in the coming years, further intensifying the need for efficient construction solutions. The Construction Utility Vehicles Market is poised to capitalize on this trend, as the vehicles play a crucial role in meeting the demands of expanding urban environments.

Labor Shortages and Workforce Challenges

The Construction Utility Vehicles Market is currently influenced by labor shortages and challenges in workforce availability. As the construction sector grapples with a diminishing skilled labor pool, there is an increasing reliance on machinery and vehicles to compensate for these gaps. The need for efficient construction utility vehicles becomes paramount, as they can perform tasks that would typically require multiple workers. This trend is likely to drive demand for advanced utility vehicles that can operate autonomously or with minimal human intervention. Consequently, the Construction Utility Vehicles Market is expected to evolve, focusing on solutions that enhance productivity while addressing labor constraints.

Growing Demand for Eco-Friendly Solutions

The Construction Utility Vehicles Market is witnessing a shift towards eco-friendly solutions, driven by increasing environmental regulations and sustainability initiatives. Manufacturers are responding to this demand by developing electric and hybrid utility vehicles that minimize carbon emissions. Recent data suggests that the market for electric construction vehicles is expected to grow significantly, as companies aim to meet regulatory standards and improve their environmental footprint. This trend not only aligns with global sustainability goals but also appeals to environmentally conscious consumers and businesses. As the Construction Utility Vehicles Market adapts to these changes, the emphasis on green technologies is likely to create new opportunities for growth and innovation.