Advancements in Battery Technology

Technological innovations in battery technology are playing a pivotal role in the Electric Utility Vehicles Market. Enhanced battery efficiency and reduced charging times are making electric utility vehicles more appealing to consumers and businesses. Recent advancements have led to the development of batteries with higher energy densities, which can extend the range of electric utility vehicles significantly. This is crucial for industries that rely on utility vehicles for long-distance operations. As battery costs continue to decline, the overall affordability of electric utility vehicles is expected to improve, further stimulating market growth.

Government Incentives and Subsidies

Government incentives and subsidies are crucial drivers for the Electric Utility Vehicles Market. Many governments are implementing policies aimed at promoting the adoption of electric vehicles, including tax credits, rebates, and grants for both consumers and manufacturers. These financial incentives lower the initial purchase cost of electric utility vehicles, making them more accessible to a broader audience. For instance, certain regions have reported a 30% increase in electric vehicle sales attributed to such incentives. This supportive regulatory environment is likely to foster further growth in the electric utility vehicle sector.

Corporate Sustainability Initiatives

The Electric Utility Vehicles Market is increasingly influenced by corporate sustainability initiatives. Many companies are committing to reducing their carbon footprints and are integrating electric utility vehicles into their fleets as part of their environmental strategies. This trend is particularly evident in sectors such as logistics and delivery, where companies are seeking to enhance their sustainability profiles. Research indicates that organizations adopting electric utility vehicles can reduce operational costs while simultaneously meeting their sustainability goals. This alignment of corporate responsibility with market offerings is expected to drive further adoption of electric utility vehicles.

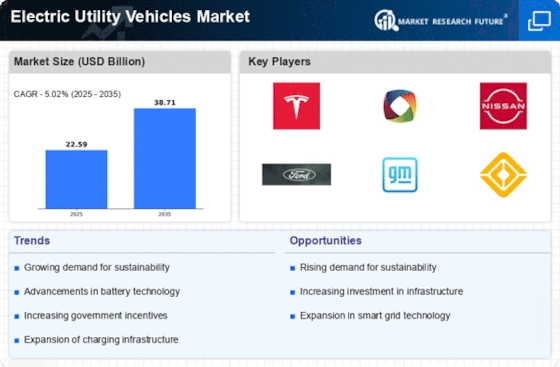

Rising Demand for Clean Transportation

The Electric Utility Vehicles Market is experiencing a notable surge in demand for clean transportation solutions. As environmental concerns escalate, consumers and businesses alike are increasingly prioritizing sustainability. This shift is reflected in the growing adoption of electric utility vehicles, which are perceived as a viable alternative to traditional fossil fuel-powered vehicles. According to recent data, the market for electric utility vehicles is projected to expand significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This trend indicates a robust market potential, driven by the need for reduced emissions and cleaner urban environments.

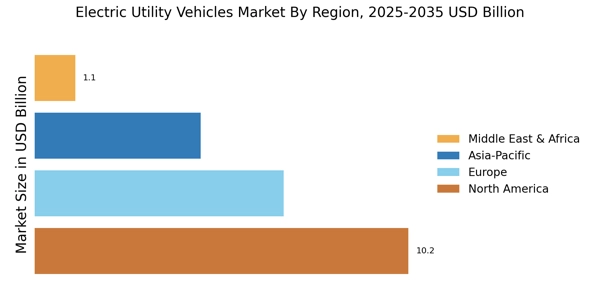

Urbanization and Infrastructure Development

Urbanization and infrastructure development are significant factors impacting the Electric Utility Vehicles Market. As urban areas expand, the demand for efficient and sustainable transportation solutions becomes increasingly critical. Electric utility vehicles are well-suited for urban environments, where they can navigate congested areas and contribute to reduced air pollution. Furthermore, the development of charging infrastructure is essential for supporting the growth of electric utility vehicles. Recent initiatives to enhance charging networks in urban centers are likely to facilitate the adoption of electric utility vehicles, making them a practical choice for businesses operating in these regions.