Focus on Equipment Longevity

In the Construction Lubricants Market, there is an increasing emphasis on the longevity and reliability of construction equipment. As machinery becomes more sophisticated, the need for high-performance lubricants that can withstand extreme conditions is paramount. The market for construction lubricants is projected to reach USD 3 billion by 2026, driven by the necessity to protect equipment from wear and tear. Lubricants play a crucial role in minimizing friction and heat generation, thereby extending the lifespan of construction machinery. This focus on equipment longevity not only reduces maintenance costs but also enhances operational efficiency, making construction lubricants indispensable in modern construction practices.

Rising Demand for Construction Activities

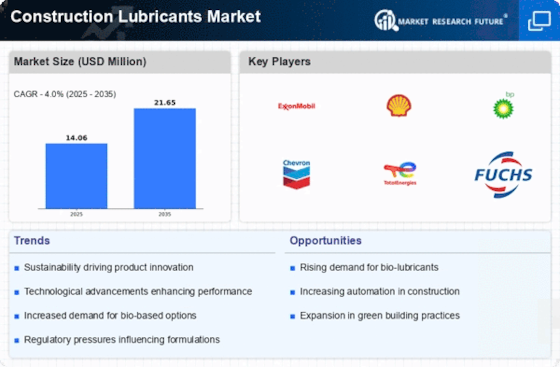

The Construction Lubricants Market is experiencing a notable surge in demand due to the increasing number of construction projects worldwide. As urbanization accelerates, the need for residential, commercial, and infrastructure development intensifies. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to drive the consumption of construction lubricants, which are essential for ensuring the smooth operation of machinery and equipment used in construction activities. The rising demand for construction lubricants is further fueled by the need for enhanced efficiency and reduced downtime in construction operations, making them a critical component in the overall construction process.

Regulatory Compliance and Environmental Standards

The Construction Lubricants Market is increasingly influenced by stringent regulatory compliance and environmental standards. Governments and regulatory bodies are implementing policies aimed at reducing the environmental impact of construction activities. This has led to a growing demand for eco-friendly lubricants that meet these regulations. The market is witnessing a shift towards biodegradable and non-toxic lubricants, which are expected to capture a significant share of the market. As companies strive to adhere to these standards, the demand for innovative construction lubricants that align with environmental goals is likely to rise, thereby shaping the future landscape of the industry.

Increased Investment in Infrastructure Development

The Construction Lubricants Market is benefiting from increased investment in infrastructure development across various regions. Governments are allocating substantial budgets for infrastructure projects, including roads, bridges, and public transportation systems. This trend is likely to boost the demand for construction lubricants, as these projects require extensive use of heavy machinery and equipment. The anticipated growth in infrastructure spending is projected to reach USD 4 trillion by 2027, creating a favorable environment for the construction lubricants market. As construction activities ramp up, the need for reliable lubricants to ensure the efficient operation of machinery will become increasingly critical.

Technological Innovations in Lubricant Formulations

Technological advancements are playing a pivotal role in the Construction Lubricants Market. Innovations in lubricant formulations are leading to the development of high-performance products that offer superior protection and efficiency. The introduction of synthetic lubricants, which provide enhanced thermal stability and resistance to oxidation, is transforming the market. These advancements are expected to drive the market growth, as construction companies increasingly seek lubricants that can improve machinery performance and reduce operational costs. The ongoing research and development in lubricant technology suggest a promising future for the construction lubricants sector, with potential for new products that cater to specific construction needs.