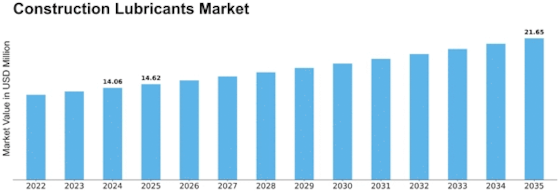

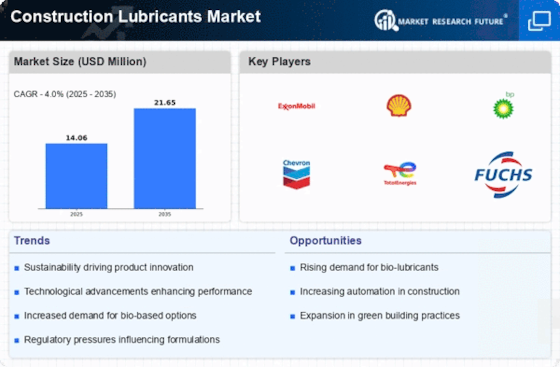

Construction Lubricants Size

Construction Lubricants Market Growth Projections and Opportunities

Construction Lubricants Market dynamics and growth are shaped by many market factors. Global construction boom is a major factor. Construction lubricants demand rises with global urbanization and infrastructure development. These lubricants keep construction machines running smoothly, improving efficiency and longevity. The construction lubricants market was worth over USD 13 million in 2018 and might rise over 4% between 2022 and 2030.

Another major element influencing the Construction Lubricants Market is changing regulations. Governments and environmental organizations are tightening laws to address environmental issues and promote sustainability. The building sector now prioritizes eco-friendly and biodegradable lubricants. As rules change, market participants are creating lubricants that meet environmental criteria while meeting construction machinery performance needs.

These price fluctuations affect the sector, thus manufacturers must modify their pricing strategy. Lubricant formulation and technology advances can affect market dynamics. Continuous research and development produces high-performance lubricants with improved wear resistance, temperature stability, and equipment life.

Geopolitical developments affect the Construction Lubricants Market. Political instability and trade conflicts can disrupt the supply chain, influencing lubricant raw material availability and pricing. Construction lubricant manufacturers must overcome these geopolitical issues to maintain a reliable supply chain.

Economic conditions in major regions impact the Construction Lubricants Market. Economic development and stability affect infrastructure building and investments. Construction may halt during economic downturns, reducing demand for construction lubricants. In times of economic boom, construction projects boost lubricant demand.

Innovation and product differentiation also drive market dynamics. Research and development of new formulas or lubricants gives companies an edge. This builds brand loyalty among construction machinery buyers seeking high-performance solutions.

Finally, equipment maintenance knowledge and the need of excellent lubricants in construction operations drive market expansion. Operators and contractors are switching to higher-quality lubricants due of their long-term benefits. The total cost of ownership, which includes lubricants' initial cost and effects on equipment longevity and operational efficiency, frequently raises awareness.

The Construction Lubricants Market is dynamic and shaped by several variables. These key elements shape the sector, from global construction patterns and environmental regulations to economic conditions and technical advances. Companies in this market must be aware of these impacts to make educated decisions and change their strategies to compete in this changing sector.

Leave a Comment