Market Trends

Key Emerging Trends in the Construction Estimate Software Market

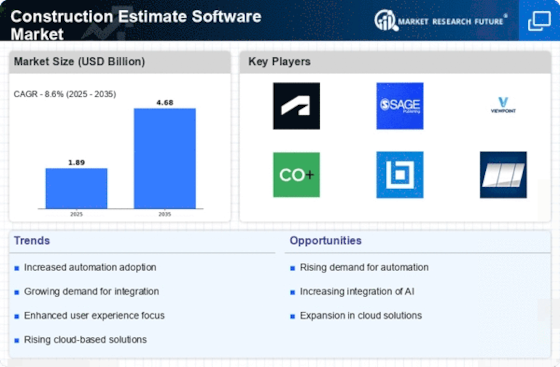

The digitalization of project management in the construction industry over the past few years has resulted in significant transformational trends in the construction estimate software sector. One such trend is an increased preference for cloud-based construction estimate software. The need for greater flexibility and collaboration among construction firms has driven the adoption of cloud based systems which allow them to be accessed from any part of the world with Internet connection. Apart from enhancing mobility, this transition to cloud technology also promotes real-time conversation between all stakeholders at different stages of project completion hence making communication between them more effective thus leading to efficient and streamlined completion processes.

The other notable trend within the construction estimate software market is its integration with artificial intelligence (AI) as well as machine learning (ML) competences. With these technologies, monotonous tasks can be automated, historical project data analyzed and estimates generated with higher accuracy levels. AI powered construction estimate software can learn from previous projects which consequently helps users improve their estimates by basing it on real performance data. Furthermore, this not only allows for accurate estimations but also aids in early identification of possible risks or challenges during planning thereby giving room for more successful outcomes in relation to a project.

Additionally, there exists clear attention towards user-friendly interfaces as well as intuitive design within the construction estimate software space. As more digital tools are being adopted by players in this field, it is becoming apparent that professionals possess differing technical abilities hence necessitating easy-to-use softwaresolutionsin place.Use friendlyinterfaceshelp increase adoptionratesand ensurethattheconstruction teamscan adoptandcapitalizeonthesoftware’spotentialswithout havingtoundergoextensivetraining.

Construction estimate software market also reflects the growing trend of integration with Building Information Modeling (BIM). This makes it possible for project managements to be more holistic as BIM helps in seamless data sharing across different construction-based processes. On the other hand, BIM integrated construction estimate software provides a more precise representation of the project scope resulting in accurate estimates and better all-round project planning.

The development of construction estimate software is also being shaped by sustainability concerns. Consequently, such solutions have been developed to include sustainability metrics in estimating costs to ensure that their users can evaluate the environmental effect of materials and building techniques which conform to the green movement within the field.

Additionally, there has been an emergence of mobile applications designed specifically for construction estimation services. Mobile friendly estimation software enables on-the-go use via smartphones and tablets since they are increasingly being depended on at sites by those involved in construction projects. As a result, mobile integration contributes towards better collaborations through communication enhancements including constant updates among other things thus leading to higher efficiencies overall when managing a project.

Leave a Comment