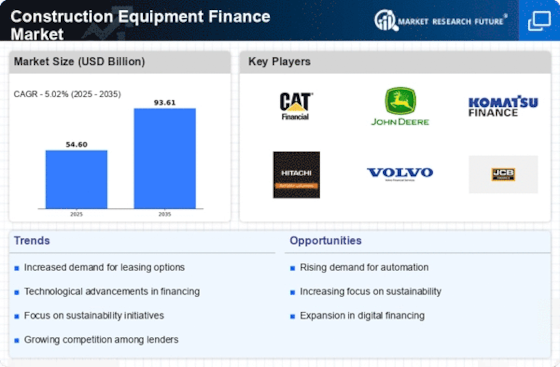

Economic Growth and Urbanization

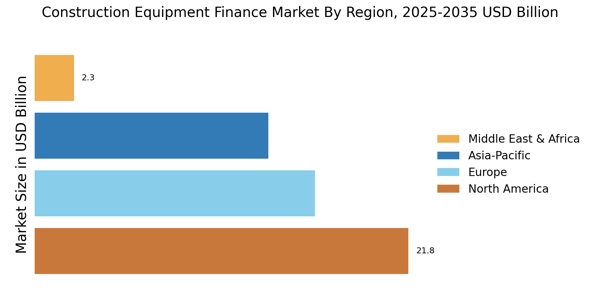

Economic growth and urbanization are pivotal factors driving the Construction Equipment Finance Market. As economies expand, there is a corresponding increase in construction activities, particularly in urban areas where infrastructure and housing demands are surging. This trend is reflected in the rising construction spending, which is anticipated to continue its upward trajectory. Urbanization leads to a greater need for construction equipment, prompting firms to seek financing options to meet their equipment needs. The Construction Equipment Finance Market is likely to experience growth as businesses look for flexible financing solutions to support their expansion efforts in rapidly urbanizing regions.

Rising Demand for Rental Equipment

The rising demand for rental equipment is another significant driver influencing the Construction Equipment Finance Market. As construction companies increasingly prefer to rent rather than purchase equipment, the need for financing solutions tailored to rental services is becoming more pronounced. This shift is driven by the desire to minimize capital expenditure and maintain operational flexibility. According to recent data, the rental equipment market is projected to grow substantially, with many firms opting for short-term financing solutions to acquire equipment on a rental basis. This trend indicates a potential shift in the financing landscape, where the Construction Equipment Finance Market may need to adapt to cater to the evolving preferences of construction firms seeking rental options.

Infrastructure Development Initiatives

The ongoing emphasis on infrastructure development initiatives appears to be a primary driver for the Construction Equipment Finance Market. Governments and private entities are increasingly investing in large-scale projects, such as highways, bridges, and urban development. This trend is evidenced by the projected increase in infrastructure spending, which is expected to reach trillions of dollars over the next decade. Such investments necessitate the acquisition of advanced construction equipment, thereby driving demand for financing solutions. The Construction Equipment Finance Market is likely to benefit from this surge, as companies seek to finance their equipment needs to participate in these lucrative projects. Furthermore, the need for timely project completion may compel firms to opt for financing options that allow for immediate access to necessary machinery.

Technological Advancements in Equipment

Technological advancements in construction equipment are reshaping the landscape of the Construction Equipment Finance Market. Innovations such as automation, telematics, and advanced machinery are enhancing operational efficiency and productivity. As construction firms seek to leverage these technologies, the demand for financing to acquire state-of-the-art equipment is likely to increase. Data suggests that the integration of technology in construction processes can lead to significant cost savings and improved project outcomes. Consequently, financing solutions that facilitate access to these advanced technologies will be crucial for companies aiming to remain competitive. The Construction Equipment Finance Market must therefore evolve to support the financing needs associated with these technological advancements.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Construction Equipment Finance Market. As governments implement stricter regulations regarding safety and environmental impact, construction firms are compelled to invest in compliant equipment. This necessity creates a demand for financing solutions that enable companies to acquire equipment meeting these standards. The financial burden of upgrading to compliant machinery can be substantial, thus financing options become essential for many firms. The Construction Equipment Finance Market must adapt to these regulatory changes, providing tailored financing solutions that address the specific needs of companies striving to comply with evolving safety and environmental regulations.