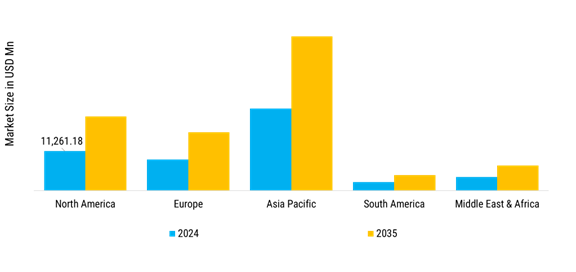

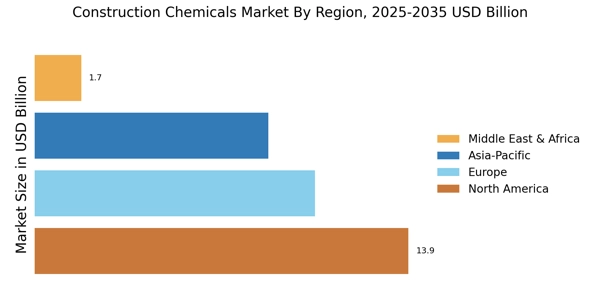

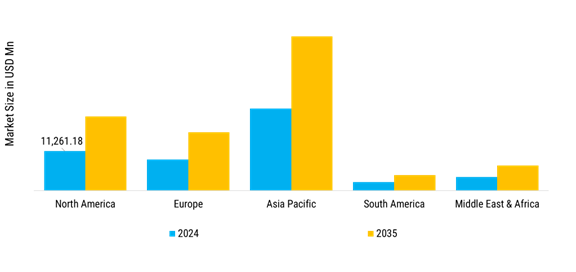

Asia-Pacific: Construction Innovation Leader

Asia-Pacific is the largest market for Construction Chemicals, holding approximately 45% of the global market share. The region's growth is driven by rapid urbanization, massive infrastructure development, and government initiatives promoting affordable housing and smart cities. The presence of major construction companies and a robust manufacturing ecosystem further fuel innovation and adoption of advanced chemical solutions. Regulatory frameworks, such as China's Green Building Action Plan and India's Smart Cities Mission, enhance demand for sustainable construction practices. Major countries include China, India, Japan, and Southeast Asian nations, with significant contributions from key players like Asian Paints, Pidilite Industries, and regional branches of global firms. The competitive landscape is characterized by rapid technological advancements and a focus on eco-friendly and high-performance solutions. Companies are increasingly investing in production capacity and R&D to meet the growing demand for scalable, durable, and sustainable construction chemicals, positioning Asia-Pacific as a hub for construction innovation.

Europe: Sustainable Construction Market

Europe is witnessing significant activity in the Construction Chemicals market, accounting for approximately 30% of the global share. The region's growth is propelled by stringent environmental regulations, infrastructure modernization, and the need for energy-efficient buildings. The European Union's Energy Performance of Buildings Directive and various green building certifications have catalyzed demand for low-VOC, sustainable construction chemicals, encouraging builders to adopt advanced solutions for enhanced performance and environmental compliance. Leading countries in this region include Germany, France, the United Kingdom, and Italy, where companies like BASF, Sika, and Saint-Gobain are making substantial impacts. The competitive landscape is evolving, with a mix of established multinational corporations and innovative regional players focusing on sustainable and circular economy solutions. The emphasis on retrofitting aging infrastructure and achieving carbon-neutral construction is also shaping market dynamics, as organizations seek high-performance, eco-friendly chemical options.

North America: Mature Infrastructure Renovation Market

North America represents a significant market for Construction Chemicals, holding around 20% of the global market share. The region's growth is driven by infrastructure rehabilitation, commercial construction expansion, and increasing adoption of green building standards. The United States leads the market, followed by Canada and Mexico, supported by government infrastructure programs and private sector investments in sustainable construction. Companies like 3M, MAPEI Americas, and W.R. Grace are expanding their presence in the region. The competitive landscape features both established players and emerging companies, with a focus on innovative repair and protection solutions for aging infrastructure. The region is characterized by diverse construction needs across sectors, including transportation, commercial real estate, and residential development, all increasingly adopting advanced construction chemicals for durability and compliance.

Middle East and Africa: Emerging High-Growth Market

The Middle East and Africa region is rapidly emerging in the Construction Chemicals market, currently holding about 5% of the global share but experiencing the fastest growth rate. The expansion is driven by mega-infrastructure projects, urban development initiatives, and increasing investments in construction resilience against extreme climates. Governments in the region, particularly in the UAE, Saudi Arabia, Qatar, and South Africa, are actively promoting large-scale construction and sustainable development, which is expected to significantly boost market growth in the coming years. Leading countries include the UAE and Saudi Arabia in the Middle East, and South Africa and Nigeria in Africa, where both regional and international players are establishing footholds. The competitive landscape is developing rapidly, with companies offering specialized solutions for extreme heat, humidity, and salinity challenges. As construction firms increasingly recognize the benefits of high-performance construction chemicals for climate adaptation and durability, the region is poised for substantial growth, driven by innovation and strategic investment in advanced construction technologies.