Top Industry Leaders in the Construction Chemicals Market

The construction chemicals market is a crucial cog in the ever-turning machinery of global infrastructure development. These specialized products enhance the performance, durability, and sustainability of building materials, playing a vital role in everything from towering skyscrapers to cozy bungalows.

The construction chemicals market is a crucial cog in the ever-turning machinery of global infrastructure development. These specialized products enhance the performance, durability, and sustainability of building materials, playing a vital role in everything from towering skyscrapers to cozy bungalows.

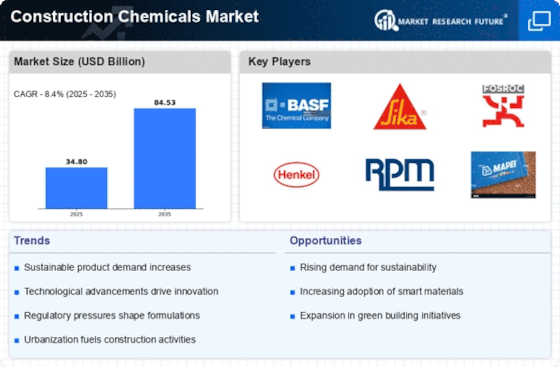

Market Size and Growth Projections:

- This growth is driven by several factors, including:

- Booming construction activity in emerging economies like China and India.

- Increasing focus on infrastructure development and urbanization.

- Growing awareness of the importance of durability and sustainability in construction.

Competitive Strategies:

-

Product innovation: Developing new and improved construction chemicals with enhanced functionalities, such as self-healing concrete or bio-based adhesives. -

Geographic expansion: Entering new markets, particularly in high-growth regions like Asia Pacific and Africa. -

Mergers and acquisitions: Consolidating market share through strategic acquisitions and partnerships. -

Sustainability focus: Investing in green technologies and developing eco-friendly construction chemicals to cater to the growing demand for sustainable construction practices.

Factors Influencing Market Share:

-

Brand reputation and product quality: Established brands with a proven track record of quality products often command a premium price and loyalty from customers. -

Distribution network and reach: Having a strong distribution network and presence in key markets is crucial for reaching a wider customer base. -

Pricing strategy: Offering competitive pricing and customized solutions can attract price-sensitive buyers and niche market segments. -

Research and development: Continuous investment in R&D helps companies stay ahead of the curve with innovative products and cater to evolving market needs.

Key Companies in the Construction Chemicals market include

- BASF SE of Germany

- Ashland Inc. of the United States

- Pidilite Industries Ltd of India

- Sika AG of Switzerland

- Fosroc Inc. of India

- Apple Chemie India Pvt Ltd of India

- Cross International Plc of United Kingdom

- Dow of the United States

- RPM International Inc. of the United States

- Grace and Company of the United States

- Henkel AG of Germany

- Evonik Industries AG of Germany

- Tata Chemicals of India

- Huntsman International LLC of the United States

- Other

Recent Developments:

Feb 2022, Sika, a manufacturer of construction chemicals, has reported its highest-ever yearly profit. Sika reported a 2 37.55 percent increase in full-year net profit and recommended a 16 percent increase in the dividend, owing to a rebound in construction projects following the pandemic and a slew of acquisitions. Sika said it aimed to raise its share of the construction chemicals market from roughly 10% presently to 12% by 2025 after making seven acquisitions last year.

Dec 2021, Saint-Gobain, a Paris-based construction materials firm, announced yesterday that it would purchase GCP Applied Technologies, a US construction chemicals company, for $2.3 billion. Saint-Gobain will pay $32 in cash for each of GCP's outstanding shares under a "definitive contract" between the two companies. According to the company, this acquisition is critical in establishing Saint-global Gobain's leadership position in construction chemicals, with total sales of more than €4 billion. It advances the group's strategy as the global leader in sustainable construction.

In May 2023, Sika AG made headlines by announcing the purchase of MBCC. Apart from this, this acquisition intends to improve the admixture solutions of Sika AG. Moreover, it will complement Sika's already existing product portfolio with various innovative platforms from MBCC that will help in reducing the carbon footprints of its clients.

In May 2023, Oriental Yuhong and Hebei Aorun Shunda Group went into a strategic cooperation agreement to carry out joint research on waterproofing membranes, thermal insulation coatings and other solutions in multi-dimensional approaches.