Market Growth Projections

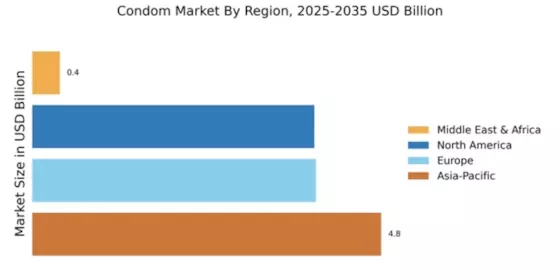

The Global Condom Market Industry is poised for substantial growth, with projections indicating a market value of 13.0 USD Billion in 2024 and an anticipated increase to 33.1 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 8.9% from 2025 to 2035. Such figures reflect the increasing acceptance of condom usage across various demographics and regions, driven by factors such as heightened awareness of sexual wellness, technological innovations, and government initiatives. The market's expansion indicates a robust demand for condoms, positioning it as a vital component of global public health strategies.

Innovations in Condom Technology

Technological advancements in condom manufacturing are a significant driver for the Global Condom Market Industry. Innovations such as ultra-thin materials, enhanced durability, and improved sensitivity are appealing to consumers seeking a more pleasurable experience. For example, the introduction of condoms made from non-latex materials caters to individuals with latex allergies, expanding the potential consumer base. These advancements not only enhance user experience but also contribute to increased sales. As the market evolves, these innovations are expected to play a crucial role in driving growth, with projections indicating a market value of 33.1 USD Billion by 2035.

Rising Awareness of Sexual Health

The Global Condom Market Industry experiences growth driven by increasing awareness surrounding sexual health and safe practices. Educational initiatives and campaigns by governments and health organizations emphasize the importance of condom use in preventing sexually transmitted infections and unintended pregnancies. For instance, various countries have implemented programs targeting youth to promote safe sex practices, which has contributed to a more informed population. This heightened awareness is likely to bolster demand, as consumers become more proactive in safeguarding their health. As a result, the market is projected to reach 13.0 USD Billion in 2024, reflecting a growing commitment to sexual health education.

Government Initiatives and Regulations

Government policies and regulations significantly influence the Global Condom Market Industry. Many countries have implemented initiatives to promote condom distribution, particularly in regions with high rates of sexually transmitted infections. For instance, free condom distribution programs in public health facilities aim to increase accessibility and encourage usage among at-risk populations. These initiatives are often supported by public health campaigns that highlight the importance of safe sex. Consequently, such government actions are likely to enhance market growth, as they create a more favorable environment for condom usage and contribute to the overall increase in market size.

Growing Demand for Eco-Friendly Products

The Global Condom Market Industry is witnessing a shift towards eco-friendly products, driven by increasing consumer awareness of environmental issues. Manufacturers are responding to this trend by developing condoms made from sustainable materials, such as organic latex and biodegradable packaging. This shift not only appeals to environmentally conscious consumers but also aligns with global sustainability goals. As more individuals prioritize eco-friendly options, the demand for these products is expected to rise, potentially influencing market dynamics. The growing emphasis on sustainability may contribute to the overall market growth, as consumers seek products that reflect their values.

Diverse Product Offerings and Customization

The Global Condom Market Industry benefits from a diverse range of product offerings that cater to various consumer preferences. Manufacturers are increasingly focusing on customization, providing options such as flavored, textured, and extra-large condoms to meet the needs of different demographics. This variety not only enhances consumer choice but also encourages trial and repeat purchases. As brands innovate and expand their product lines, they are likely to attract a broader audience. The market's ability to adapt to consumer preferences may play a pivotal role in sustaining growth, particularly as the industry anticipates a CAGR of 8.9% from 2025 to 2035.