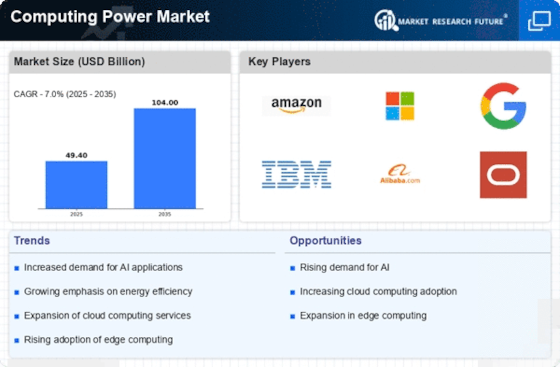

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Computing Power Market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Computing Power industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Computing Power industry to benefit clients and increase the market sector. In recent years, the Computing Power industry has offered some of the most significant advantages to technology. Major players in the Computing Power Market, including Atos SE, Advanced Micro Devices, Inc., Hewlett Packard Enterprise Development LP, Dell Inc., Cisco Systems, Inc., Fujitsu, Intel Corporation, IBM, Microsoft, Amazon Web Services, Inc., and others, are attempting to increase market demand by investing in research and development operations.

AMD (Advanced Micro Devices, Inc.) is a corporation and semiconductor manufacturer headquartered in Santa Clara, California, that produces computer processors and related technologies for both commercial and consumer processors. Leading the industry in high-performance and adaptable computing, AMD powers the goods and services that contribute to resolving the biggest problems facing humanity. The company's innovations will improve embedded, PC, gaming, and data center industries going forward. When AMD was first well-known in 1969 as a startup in Silicon Valley, it had dozens of workers who were passionate about developing cutting-edge semiconductor devices.

AMD has developed into an international corporation that defines the current computing standard, achieving various firsts for the industry and significant technological advancements.

In March AMD, a semiconductor producer, unveiled its next-generation EPYC Milan-X processors. These CPUs were created especially for high-performance computer applications and data centers. Data processing may be completed more quickly and effectively thanks to the Milan-X processors' increased performance and efficiency.

Dell Inc. is an American technology firm that creates, sells, repairs, and maintains computers and related goods and services. Dell Technologies, the company's parent, is the owner of Dell. Dell offers a variety of products, including PCs, servers, data storage devices, network switches, software, computer peripherals, HDTVs, cameras, and its supply chain. It includes Dell selling directly to consumers and fulfilling their requests for PCs. Prior to purchasing Perot Systems in 2009, Dell was a hardware manufacturer. Dell then made a move into the IT services sector. The business has upgraded its networking and storage infrastructure.

From just providing PCs, it is now growing to offer a variety of technologies to business clients.

In February Dell, a computer technology business, introduced the Dell EMC PowerEdge XE8545 server. In order to encounter the demands of sectors requiring strong processing capabilities, this server was tuned for high-performance computing workloads. The PowerEdge XE8545 server offered improved performance to manage taxing jobs and data-intensive apps.