Cost Efficiency

Cost efficiency remains a driving force in the Composite Pallet Market. As companies strive to optimize their operational expenses, the adoption of composite pallets presents a viable solution. These pallets often exhibit a longer lifespan and lower maintenance costs compared to traditional wooden pallets. Additionally, their lightweight nature can lead to reduced shipping costs, further enhancing overall cost savings. Market analysis indicates that businesses that switch to composite pallets can achieve significant reductions in logistics expenses. Consequently, the pursuit of cost-effective solutions is likely to sustain the growth of the Composite Pallet Market.

Regulatory Compliance

Regulatory compliance is becoming increasingly critical within the Composite Pallet Market. Governments and regulatory bodies are implementing stringent guidelines regarding packaging materials and waste management. As a result, companies are compelled to adopt compliant solutions, which often include the use of composite pallets that meet environmental standards. The emphasis on reducing plastic waste and promoting recyclable materials is likely to propel the demand for composite pallets. Furthermore, businesses that proactively align with these regulations may gain a competitive edge, positioning themselves favorably within the Composite Pallet Market.

Rising E-commerce Demand

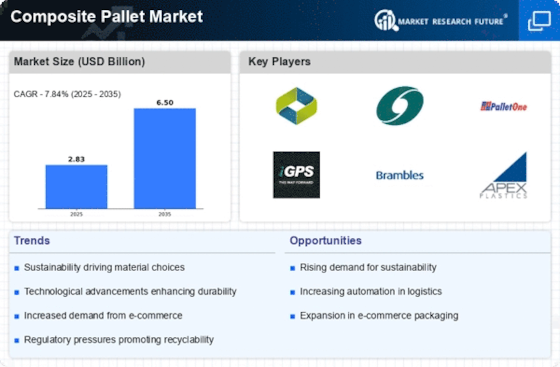

The surge in e-commerce activities is significantly influencing the Composite Pallet Market. With the increasing volume of online shopping, there is a corresponding rise in the need for efficient packaging and transportation solutions. Composite pallets offer advantages such as lightweight design and durability, making them ideal for the fast-paced logistics environment associated with e-commerce. Market data suggests that the e-commerce sector is projected to grow at a compound annual growth rate of over 15% in the coming years. This growth is likely to drive demand for composite pallets, as businesses seek to optimize their supply chains.

Sustainability Initiatives

The Composite Pallet Market is experiencing a notable shift towards sustainability initiatives. Companies are increasingly prioritizing eco-friendly materials and practices, which is driving demand for composite pallets made from recycled and renewable resources. This trend aligns with the growing consumer preference for sustainable products, as businesses seek to reduce their carbon footprint. In fact, the market for sustainable packaging solutions is projected to reach substantial figures, indicating a robust growth trajectory. As organizations adopt greener supply chain practices, the Composite Pallet Market is likely to benefit from heightened interest in environmentally responsible alternatives.

Technological Advancements

Technological advancements play a pivotal role in shaping the Composite Pallet Market. Innovations in materials science and manufacturing processes are leading to the development of lighter, stronger, and more durable composite pallets. These advancements not only enhance the performance of pallets but also contribute to cost savings in logistics and transportation. For instance, the introduction of advanced composite materials can reduce weight by up to 30% compared to traditional wooden pallets, thereby lowering shipping costs. As technology continues to evolve, the Composite Pallet Market is expected to witness increased adoption of these innovative solutions.