Rising E-commerce Demand

The surge in e-commerce activities globally is a primary driver of the Global Pallet Racking Market Industry. As online retail continues to expand, warehouses and distribution centers require efficient storage solutions to manage increased inventory levels. This demand is reflected in the projected market value of 11.4 USD Billion in 2024, as businesses seek to optimize their logistics and supply chain operations. The need for advanced pallet racking systems that can accommodate diverse product types and sizes is becoming increasingly critical, suggesting a robust growth trajectory for the industry.

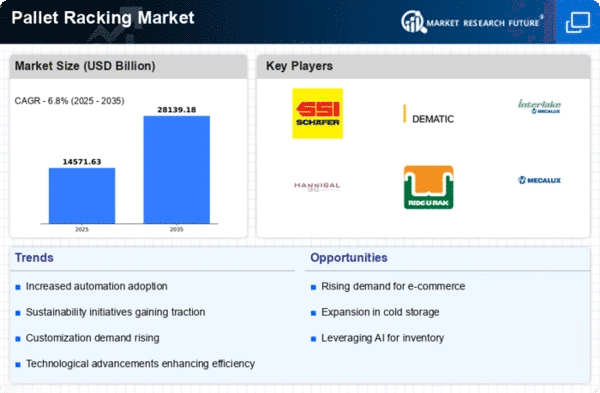

Market Growth Projections

The Global Pallet Racking Market Industry is poised for substantial growth, with projections indicating a market value of 11.4 USD Billion in 2024 and an anticipated increase to 25.4 USD Billion by 2035. The compound annual growth rate (CAGR) of 7.55% from 2025 to 2035 underscores the industry's potential for expansion. This growth is driven by various factors, including rising e-commerce demand, technological advancements, and increased focus on warehouse optimization. As businesses continue to adapt to evolving market conditions, the demand for innovative pallet racking solutions is likely to remain strong.

Sustainability Initiatives

Sustainability is becoming a crucial consideration in the Global Pallet Racking Market Industry. Companies are increasingly seeking eco-friendly racking solutions that minimize environmental impact. This shift is prompting manufacturers to develop sustainable materials and designs that align with green building practices. As businesses strive to meet regulatory requirements and consumer expectations for sustainability, the demand for environmentally responsible pallet racking systems is likely to grow. This trend may contribute to the overall expansion of the market as organizations prioritize sustainable logistics and supply chain practices.

Technological Advancements

Innovations in pallet racking technology are significantly influencing the Global Pallet Racking Market Industry. Automated systems, such as robotic palletizers and smart racking solutions, enhance efficiency and reduce labor costs. These advancements allow for better space utilization and inventory management, which are essential in modern warehousing. As companies adopt these technologies, the market is expected to grow substantially, with a projected CAGR of 7.55% from 2025 to 2035. This trend indicates that businesses are increasingly investing in sophisticated racking systems to remain competitive in a rapidly evolving market.

Global Supply Chain Resilience

The need for resilient global supply chains is a significant driver of the Global Pallet Racking Market Industry. Recent disruptions have highlighted the importance of robust logistics and warehousing solutions. Companies are investing in flexible and scalable racking systems to adapt to changing market conditions and consumer demands. This investment is expected to bolster the market, as businesses prioritize the establishment of reliable supply chains. The ongoing evolution of global trade dynamics suggests that the demand for effective pallet racking solutions will continue to rise, supporting the industry's growth.

Increased Focus on Warehouse Optimization

The growing emphasis on warehouse optimization is driving the Global Pallet Racking Market Industry. Companies are recognizing the importance of maximizing storage capacity and improving operational efficiency. This focus is leading to the adoption of various racking systems that can accommodate high-density storage and facilitate easy access to products. As a result, the market is projected to reach 25.4 USD Billion by 2035, reflecting the industry's response to the need for more effective warehousing solutions. Enhanced storage capabilities not only improve productivity but also contribute to cost savings for businesses.