Market Analysis

In-depth Analysis of Competent Cells Market Industry Landscape

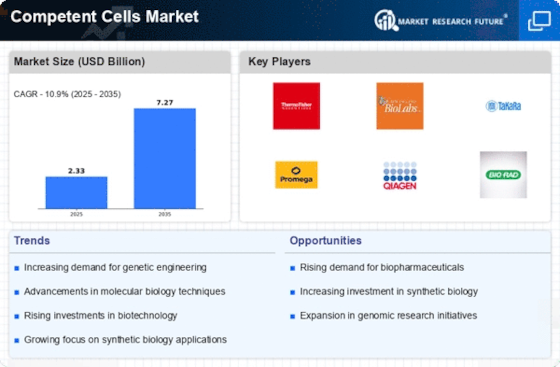

There are various factors affecting the Competent Cells Market, which shape its dynamics and growth collectively. Increasing demand for genetic engineering and molecular biology applications is a major driving force behind this market. Advancements made in scientific research and technology significantly influence the overall competent cells market. Currently, researchers concentrate on developing new strains of competent cells with higher transformation efficiencies tailored toward diverse applications. The emergence of sophisticated genome editing techniques such as CRISPR-Cas9 has further fueled the demand for specialized competence cells, hence expanding the market. Regulatory considerations play a significant role in the development and commercialization of competent cells. Stringent regulatory standards ensure the safety and reliability of these cell lines, instilling confidence in researchers and biotechnologists. Economic factors have a great impact on this market. Economic growth and stability increase funding for research, leading to improved accessibility of academic institutions, research organizations, and biotechnology companies to competent cells. On the other hand, during economic downturns, there might be changes in spending priorities within R&D budgets, thereby altering competitiveness. Cost-effectiveness and wide availability become important decision-making criteria, particularly where financial determinants tend to outweigh scientific reasons behind conducting research. A key market factor is the competitive landscape between biotechnology companies and makers of competent cells. Companies compete intensely to develop more advanced and specialized competent cell products that can give them an edge, which encourages innovation. Consumer preferences influence the choice of researchers and scientists regarding competent cells. High transformation efficiency, specific application compatibility, and ease of use are important factors to consider by researchers when selecting effective, competent cells for their experiments. Additionally, competitive cell markets are constrained by the total structure of scientific community research and funding policies. Research funds accessibility, biotechnology research support policies by governments, and institutional priorities impact adoption decisions on certain competent cell technologies, thereby impacting market dynamics.

Leave a Comment