Rising Applications in Biotechnology

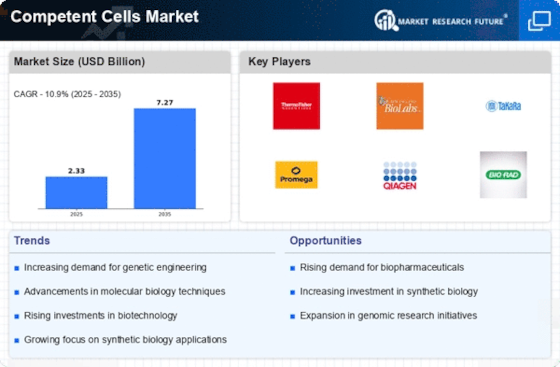

The Competent Cells Market is experiencing a surge in applications across various biotechnology sectors. This growth is primarily driven by the increasing need for genetic modifications and recombinant DNA technology. As biopharmaceutical companies expand their research and development efforts, the demand for competent cells, which facilitate the transformation of plasmids into host cells, is likely to rise. In 2023, the biotechnology sector accounted for a substantial portion of the overall market, with projections indicating a continued upward trajectory. The versatility of competent cells in producing proteins, enzymes, and vaccines further enhances their relevance in the industry. Consequently, the expansion of biotechnology applications is a pivotal driver for the Competent Cells Market.

Growing Investment in Genomic Research

Investment in genomic research is a critical driver for the Competent Cells Market. As governments and private entities allocate substantial funding towards genomics, the demand for competent cells is likely to escalate. In 2023, global investments in genomic research reached unprecedented levels, with a focus on understanding genetic diseases and developing targeted therapies. Competent cells play a vital role in these research endeavors, serving as essential tools for gene cloning and manipulation. The increasing emphasis on genomics is expected to create a robust market for competent cells, as researchers require high-quality products to facilitate their studies. This trend highlights the interconnectedness of genomic research and the Competent Cells Market.

Expansion of Synthetic Biology Initiatives

The expansion of synthetic biology initiatives is significantly impacting the Competent Cells Market. As organizations and academic institutions increasingly adopt synthetic biology approaches, the need for competent cells to support these initiatives is growing. Synthetic biology relies heavily on the manipulation of genetic material, and competent cells are crucial for the successful implementation of these techniques. In recent years, numerous synthetic biology projects have emerged, focusing on applications such as biofuel production and environmental remediation. This burgeoning field is expected to drive demand for competent cells, as researchers seek efficient methods for constructing and testing synthetic organisms. The rise of synthetic biology initiatives thus represents a key driver for the Competent Cells Market.

Increased Focus on Research and Development

The heightened focus on research and development (R&D) across various sectors is a significant driver for the Competent Cells Market. Organizations are increasingly investing in R&D to foster innovation and develop new products, particularly in the fields of biotechnology and pharmaceuticals. This trend is evident in the substantial growth of R&D expenditures, which have seen a steady increase in recent years. Competent cells are integral to R&D processes, enabling scientists to conduct experiments related to gene expression and protein production. As the demand for novel therapies and biotechnological solutions rises, the reliance on competent cells is expected to grow. This emphasis on R&D thus serves as a crucial catalyst for the Competent Cells Market.

Technological Innovations in Cell Transformation

Technological advancements in cell transformation techniques are significantly influencing the Competent Cells Market. Innovations such as electroporation and heat shock methods have improved the efficiency of competent cell preparation, leading to higher transformation rates. These advancements not only enhance the performance of competent cells but also reduce the time and resources required for genetic engineering projects. In recent years, the introduction of new competent cell strains with optimized properties has further propelled market growth. As researchers seek more efficient and reliable methods for gene cloning and expression, the demand for technologically advanced competent cells is expected to increase. This trend underscores the importance of innovation in driving the Competent Cells Market.