Rising Demand for Clean Energy Solutions

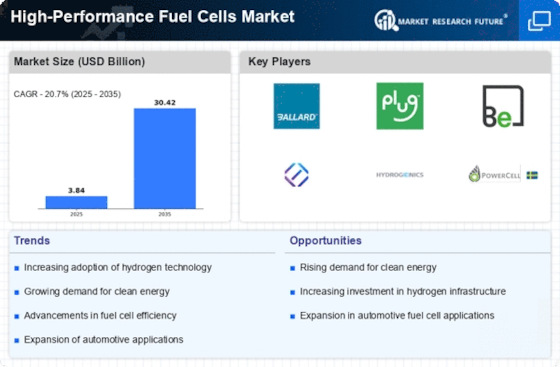

The increasing global emphasis on sustainability and reducing carbon emissions drives the High-Performance Fuel Cells Market. As nations strive to meet stringent environmental regulations, the demand for clean energy solutions has surged. Fuel cells, known for their efficiency and low emissions, are becoming a preferred choice in various sectors, including transportation and stationary power generation. According to recent data, the fuel cell market is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend indicates a robust shift towards cleaner technologies, positioning high-performance fuel cells as a pivotal component in the transition to a sustainable energy future.

Growing Applications in Transportation Sector

The transportation sector is witnessing a notable shift towards high-performance fuel cells, which is a key driver for the High-Performance Fuel Cells Market. With the automotive industry increasingly focusing on reducing greenhouse gas emissions, fuel cell electric vehicles (FCEVs) are gaining traction as a viable alternative to traditional internal combustion engines. Major automotive manufacturers are investing heavily in fuel cell technology, with projections indicating that the number of FCEVs on the road could reach millions by the end of the decade. This growing adoption in transportation not only enhances the market potential for fuel cells but also contributes to the overall reduction of carbon emissions in the sector.

Technological Innovations in Fuel Cell Design

Technological advancements play a crucial role in shaping the High-Performance Fuel Cells Market. Innovations in materials, such as the development of more efficient catalysts and membranes, enhance the performance and durability of fuel cells. These improvements not only increase the efficiency of energy conversion but also reduce costs, making fuel cells more accessible for various applications. For instance, advancements in hydrogen storage technologies are expected to facilitate the widespread adoption of fuel cells in transportation. As these technologies continue to evolve, they are likely to drive market growth and expand the range of applications for high-performance fuel cells.

Government Incentives and Regulatory Frameworks

Government support and favorable regulatory frameworks significantly influence the High-Performance Fuel Cells Market. Many governments are implementing policies that promote the adoption of clean energy technologies, including fuel cells. Incentives such as tax credits, grants, and subsidies encourage businesses and consumers to invest in fuel cell technologies. For example, several countries have established targets for hydrogen production and fuel cell deployment, which are expected to create a conducive environment for market expansion. This proactive approach by governments not only stimulates demand but also fosters innovation within the industry, paving the way for a more sustainable energy landscape.

Increased Investment in Research and Development

Investment in research and development (R&D) is a significant driver of the High-Performance Fuel Cells Market. As competition intensifies, companies are allocating substantial resources to innovate and improve fuel cell technologies. This focus on R&D aims to enhance efficiency, reduce costs, and expand the range of applications for fuel cells. Recent reports indicate that global investment in fuel cell R&D has increased, with both private and public sectors recognizing the potential of fuel cells in achieving energy transition goals. Such investments are likely to yield breakthroughs that will further propel the market, making high-performance fuel cells a cornerstone of future energy systems.