Urbanization Trends

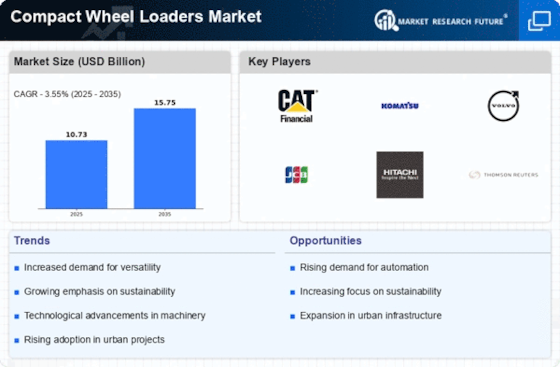

The Compact Wheel Loaders Market is significantly influenced by ongoing urbanization trends. As urban areas expand, the demand for efficient construction and maintenance equipment rises. Compact wheel loaders are particularly suited for urban environments due to their size and versatility, allowing them to navigate tight spaces and perform various tasks effectively. With urban populations projected to increase, the construction and maintenance of infrastructure will require reliable machinery. This trend is expected to contribute to a steady growth rate of approximately 5.8% in the Compact Wheel Loaders Market over the next several years, as cities seek to modernize and expand their facilities.

Focus on Sustainability

The Compact Wheel Loaders Market is increasingly aligning with sustainability initiatives as companies seek to reduce their environmental impact. The demand for eco-friendly machinery is on the rise, with manufacturers developing compact wheel loaders that utilize alternative fuels and energy-efficient technologies. This shift is not only driven by regulatory pressures but also by consumer preferences for sustainable practices. The market for green construction equipment is anticipated to grow by 7% annually, indicating a strong potential for compact wheel loaders that meet these criteria. As sustainability becomes a priority, the Compact Wheel Loaders Market is likely to adapt, offering products that align with these values.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Compact Wheel Loaders Market. Innovations such as telematics, advanced hydraulic systems, and improved fuel efficiency are enhancing the performance and reliability of compact wheel loaders. These technologies not only increase productivity but also reduce operational costs, making them more appealing to end-users. The integration of smart technologies is expected to drive a 6% increase in market growth over the next few years. As manufacturers continue to innovate, the Compact Wheel Loaders Market is likely to see a shift towards more sophisticated and efficient machinery, catering to the evolving needs of various sectors.

Rising Demand in Agriculture

The Compact Wheel Loaders Market is witnessing a notable increase in demand from the agricultural sector. Farmers and agricultural businesses are increasingly adopting compact wheel loaders for their versatility in handling various tasks, such as loading, transporting, and grading. The agricultural machinery market is expected to grow at a rate of 4.5% annually, indicating a robust potential for compact wheel loaders. These machines are particularly advantageous in smaller farms where space is limited, allowing for efficient operation without compromising on power. As agricultural practices evolve, the Compact Wheel Loaders Market is likely to benefit from this growing trend, as more operators recognize the value of compact equipment.

Increased Infrastructure Development

The Compact Wheel Loaders Market is experiencing a surge due to heightened infrastructure development initiatives across various regions. Governments are investing significantly in public works, including roads, bridges, and urban development projects. This trend is likely to drive demand for compact wheel loaders, which are essential for material handling and earthmoving tasks. According to recent data, the construction sector is projected to grow at a compound annual growth rate of 5.2% over the next five years, further bolstering the Compact Wheel Loaders Market. As construction companies seek efficient and versatile machinery, compact wheel loaders are becoming increasingly favored for their maneuverability and performance in confined spaces.