Expansion of Rental Services

The compact loaders market is being positively impacted by the expansion of rental services. This trend is occurring across the United States. Many construction companies and contractors prefer renting equipment rather than purchasing it outright, as this approach reduces capital expenditure and maintenance costs. The rental market for compact loaders is expected to grow by approximately 10% in 2025, driven by the flexibility and convenience that rental services offer. This trend allows businesses to access the latest models without the burden of ownership, enabling them to adapt quickly to changing project requirements. As rental services continue to proliferate, they are likely to play a crucial role in driving the compact loaders market, providing users with a cost-effective solution for their equipment needs.

Rising Construction Activities

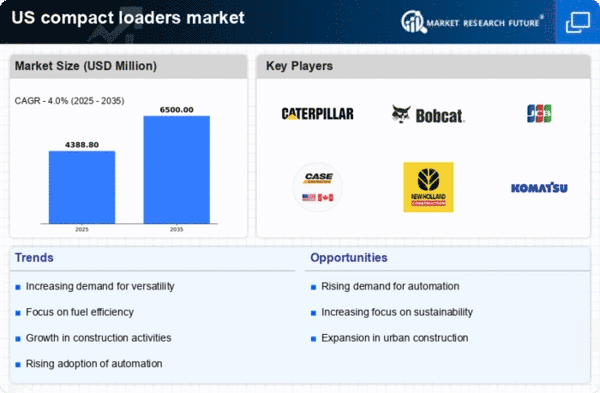

The compact loaders market is experiencing a notable surge. This is due to the increasing construction activities across the United States. As urbanization accelerates, the demand for compact loaders is likely to rise, driven by their efficiency in navigating tight spaces and performing various tasks. In 2025, the construction sector is projected to grow by approximately 5.5%, which could further bolster the compact loaders market. These machines are essential for tasks such as excavation, landscaping, and material handling, making them indispensable in both residential and commercial projects. The versatility and maneuverability of compact loaders enable them to adapt to diverse job sites, thereby enhancing their appeal to contractors and builders. Consequently, the growth in construction activities is a significant driver for the compact loaders market, as it aligns with the industry's need for efficient and reliable equipment.

Increased Focus on Sustainability

The compact loaders market is witnessing a shift towards more sustainable practices. Environmental concerns are gaining prominence in the construction and landscaping industries. Companies are increasingly seeking equipment that minimizes emissions and reduces their carbon footprint. This trend is reflected in the growing interest in electric and hybrid compact loaders, which offer lower emissions compared to traditional diesel models. In 2025, it is estimated that the market for electric compact loaders could expand by 20%, indicating a strong preference for eco-friendly options. As regulations become stricter and consumers demand greener solutions, manufacturers are likely to innovate and develop more sustainable models. This focus on sustainability not only enhances the compact loaders market but also aligns with broader industry goals of reducing environmental impact and promoting responsible resource management.

Growing Demand in Landscaping Sector

The compact loaders market is experiencing a surge in demand from the landscaping sector. This sector is increasingly recognizing the utility of these machines for various applications. Compact loaders are particularly valued for their ability to perform tasks such as soil preparation, debris removal, and material transport in residential and commercial landscaping projects. In 2025, the landscaping industry is projected to grow by around 6%, which could further stimulate the compact loaders market. As landscaping projects become more complex and require specialized equipment, the versatility of compact loaders makes them an attractive option for landscapers. This growing demand from the landscaping sector is likely to contribute significantly to the overall expansion of the compact loaders market.

Technological Integration in Equipment

The compact loaders market is significantly influenced by the integration of advanced technologies. These technologies enhance equipment design and functionality. Innovations such as telematics, automation, and improved hydraulic systems are enhancing the performance and efficiency of compact loaders. For instance, telematics systems allow operators to monitor machine performance in real-time, leading to better maintenance and reduced downtime. In 2025, it is projected that the adoption of smart technologies in compact loaders could increase by 15%, reflecting a growing trend towards data-driven decision-making in the industry. This technological evolution not only improves operational efficiency but also enhances safety features, making compact loaders more appealing to users. As the industry embraces these advancements, the compact loaders market is likely to benefit from increased demand for high-tech, efficient machinery.