Market Trends

Key Emerging Trends in the Commercial Printing Market

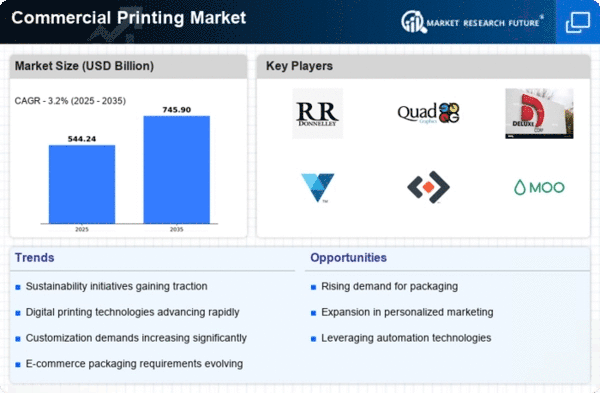

The commercial printing market is subject to a multitude of market trends that influence its trajectory and shape the industry's future. One prominent trend is the increasing demand for personalized and customized printing solutions. As businesses recognize the importance of tailored marketing materials, commercial printers are witnessing a surge in requests for unique and personalized prints, ranging from packaging to promotional items. This trend reflects a shift towards more targeted and engaging communication strategies in the commercial printing sector.

Sustainability has emerged as a pivotal market trend, driven by growing environmental consciousness. Customers and businesses are placing a premium on eco-friendly printing practices, leading to the adoption of sustainable materials, water-based inks, and energy-efficient printing processes. Commercial printers are responding to this trend by integrating environmentally friendly practices into their operations, not only to meet customer expectations but also to align with global efforts towards sustainability.

Digital transformation continues to be a significant trend shaping the commercial printing market. The advent of digital printing technologies has revolutionized the industry, offering quicker turnaround times, cost-effective short-run printing, and enhanced flexibility in terms of design and customization. As a result, traditional offset printing is gradually being complemented, and in some cases replaced, by digital alternatives, reflecting the industry's adaptation to the digital age.

E-commerce growth is driving the demand for packaging materials, marking another influential trend in the commercial printing market. The rise of online shopping has led to an increased need for eye-catching and informative packaging, contributing to the expansion of the commercial printing sector. Printers are leveraging this trend by offering innovative packaging solutions that not only protect products but also serve as a key component of brand identity in the competitive e-commerce landscape.

The integration of augmented reality (AR) and interactive print is a rising trend in commercial printing. Print materials are no longer confined to static images and text; instead, they become interactive experiences through the use of AR technology. This trend adds a layer of engagement and interactivity to printed materials, providing businesses with new opportunities to connect with their audience and enhance the overall impact of their printed collateral.

Cross-media marketing is another notable trend influencing the commercial printing industry. Businesses are increasingly adopting integrated marketing strategies that combine both print and digital channels. This trend reflects the acknowledgment that a cohesive and synchronized approach across various media platforms can amplify the effectiveness of marketing campaigns. Commercial printers are adapting to this trend by offering integrated services that span both traditional and digital channels.

The demand for specialty printing services is on the rise as businesses seek unique and eye-catching ways to stand out in a crowded market. Specialty finishes, such as embossing, foil stamping, and varnishing, are gaining popularity for their ability to add a tactile and premium feel to printed materials. This trend highlights the importance of differentiation and creativity in commercial printing to meet the evolving aesthetic preferences of clients.

Automation and artificial intelligence (AI) are becoming integral to the commercial printing landscape. Automation streamlines production processes, reduces errors, and enhances overall efficiency. AI is being used for predictive maintenance, quality control, and data analysis, providing commercial printers with valuable insights to optimize their operations. These technological trends signify a move towards a more automated and data-driven approach in the commercial printing industry.

Leave a Comment