Top Industry Leaders in the Commercial Printing Market

The Competitive Landscape of the Commercial Printing Market

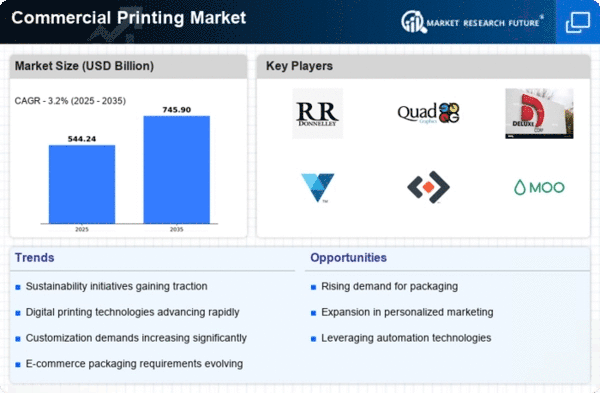

The commercial printing market, where ink meets paper and pixels form pages, remains a resilient titan despite digital challenges. This diversified domain witnesses established giants and niche innovators clashing for a share of the printed word. From high-volume packaging and advertising prints to personalized brochures and on-demand booklets, commercial printing caters to a spectrum of needs, adapting to technological advancements and changing consumer preferences. Let's delve into the key strategies and players shaping this intricate panorama.

Key Player:

- Quad/Graphics Inc.

- Acme Printing

- Cenveo

- RR Donnelley

- Transcontinental Inc.

- LSC Communications US, LLC.

- Gorham Printing, Inc.

- Dai Nippon Printing

- The Magazine Printing Company

- Quebecor World Inc.

- HH Global

- Cimpress PLC

Strategies Adopted by Market Leaders:

- Technological Differentiation: Companies compete fiercely on technological advancements, embracing digital printing processes like inkjet and toner technology for faster turnaround times, personalization options, and cost-effectiveness. Investing in automation, artificial intelligence for print optimization, and data analytics capabilities further enhance efficiency and quality control.

- Diversification and Specialization: Recognizing the changing market landscape, established players diversify their offerings beyond traditional offset printing. Expanding into packaging solutions, marketing materials, promotional products, and digital printing services caters to evolving client needs and opens new revenue streams.

- Sustainability Focus: Environmental concerns are gaining traction, prompting companies to adopt sustainable practices like using recycled paper, adopting energy-efficient equipment, and minimizing waste generation. Offering carbon-neutral printing options and highlighting ecological commitments attract environmentally conscious clients and strengthen brand image.

- Data-Driven Marketing and Customer Acquisition: Utilizing data analytics tools to understand customer needs, personalize offerings, and target specific markets becomes increasingly crucial. Implementing online ordering platforms, offering seamless integration with marketing campaigns, and providing real-time production updates enhance customer experience and drive loyalty.

Factors for Market Share Analysis:

- Revenue Generated: This key metric reflects a company's market penetration and financial strength.

- Volume of Printed Materials: Understanding the quantity of printed pages, packaging units, or promotional materials produced provides insight into production capacity and market reach.

- Service Portfolio Diversification: Analyzing the range of printing services offered, from pre-press to finishing and logistics, reveals a company's ability to cater to diverse client needs.

- Technological Investments and Innovations: Evaluating a company's commitment to digital printing, automation, and sustainable practices sheds light on its future competitive edge.

New and Emerging Companies:

The influx of innovative startups is adding fresh ink to the printing landscape. Companies like Print Direction Inc. (USA) and Taylor Communications (USA) introduce novel approaches like on-demand booklet printing, custom packaging solutions for small businesses, and localized printing services for regional markets. These advancements cater to niche needs, enhance personalization options, and further fragment the market.

Industry Developments:

Transcontinental Inc. (Canada):

- January 9, 2024- Acquired competitor Paper Converting Group Holdings Inc., expanding its packaging solutions portfolio and geographical reach.

Centevo Corporation (USA):

- December 5, 2023- Launched a new online platform for short-run digital printing, targeting small businesses and marketing agencies.

Quad/Graphics Inc. (USA):

- November 9, 2023- Invested in artificial intelligence-powered software for print optimization and waste reduction, improving efficiency and sustainability.