Rising Demand in Personal Care Products

The increasing consumer preference for high-quality personal care products appears to be a significant driver for the Acrylates Copolymer Market. Acrylates copolymers are widely utilized in formulations for skin care, hair care, and cosmetics due to their excellent film-forming properties and ability to enhance product stability. The personal care sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years, which may lead to heightened demand for acrylates copolymers. This trend suggests that manufacturers are likely to invest in innovative formulations that incorporate these materials, thereby expanding their market presence. As consumers become more discerning about product ingredients, the role of acrylates copolymers in delivering effective and safe personal care solutions is expected to become increasingly prominent.

Surge in Demand for Coatings and Paints

The rising demand for high-performance coatings and paints is anticipated to drive growth in the Acrylates Copolymer Market. Acrylates copolymers are extensively used in the formulation of water-based coatings, which are favored for their low environmental impact and excellent performance characteristics. The coatings market is expected to grow at a rate of approximately 6% per year, fueled by the construction and automotive sectors. As regulations become more stringent regarding volatile organic compounds, the shift towards water-based systems is likely to enhance the demand for acrylates copolymers. This trend indicates a robust market potential for these materials in the coatings industry, as manufacturers seek to develop sustainable and high-quality products.

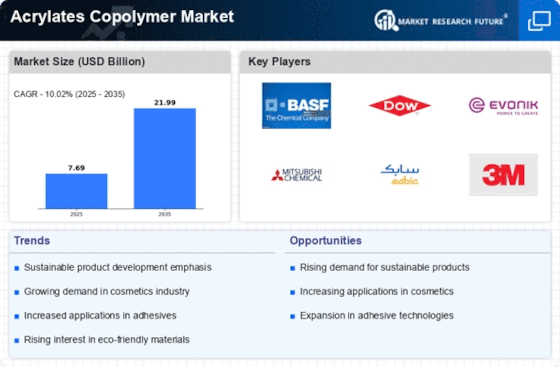

Increasing Focus on Sustainable Practices

The growing emphasis on sustainability within various industries is likely to influence the Acrylates Copolymer Market positively. As companies strive to reduce their environmental footprint, the demand for eco-friendly materials, including bio-based acrylates copolymers, is expected to rise. This shift aligns with global trends towards sustainable manufacturing practices and the adoption of green chemistry principles. The market for sustainable polymers is projected to expand significantly, with consumers increasingly favoring products that are environmentally responsible. This suggests that acrylates copolymers, which can be formulated to meet sustainability criteria, may find enhanced acceptance across multiple sectors. The focus on sustainability could thus serve as a catalyst for innovation and growth within the acrylates copolymer market.

Growth in Adhesives and Sealants Applications

The expanding applications of acrylates copolymers in adhesives and sealants are likely to bolster the Acrylates Copolymer Market. These materials are favored for their superior adhesion properties and versatility across various substrates. The adhesives market is anticipated to witness a growth rate of around 4% annually, driven by sectors such as construction, automotive, and packaging. As industries seek more efficient and durable bonding solutions, the demand for acrylates copolymers is expected to rise. Furthermore, the trend towards eco-friendly adhesives may also enhance the appeal of acrylates copolymers, as they can be formulated to meet stringent environmental regulations. This evolving landscape indicates a promising future for acrylates copolymers in adhesive applications.

Technological Innovations in Polymer Chemistry

Technological advancements in polymer chemistry are likely to play a crucial role in shaping the Acrylates Copolymer Market. Innovations in synthesis techniques and formulation strategies may lead to the development of new acrylates copolymers with enhanced properties, such as improved thermal stability and better compatibility with other materials. The market for specialty polymers is projected to grow significantly, with an expected increase in demand for high-performance materials across various industries. This suggests that ongoing research and development efforts could yield novel acrylates copolymers that meet the evolving needs of end-users. As manufacturers strive to differentiate their products, the integration of cutting-edge technologies into acrylates copolymer production may become increasingly important.