Rising Business Complexity

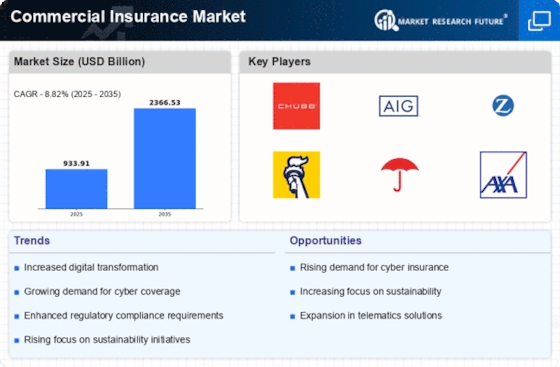

The Commercial Insurance Market is experiencing a notable increase in demand due to the rising complexity of business operations. As companies expand their activities across various sectors, they encounter a multitude of risks that necessitate comprehensive insurance coverage. This complexity is further exacerbated by regulatory changes and evolving market dynamics, compelling businesses to seek tailored insurance solutions. In 2025, the market is projected to grow at a rate of approximately 5.5% annually, driven by the need for specialized coverage that addresses unique operational risks. Insurers are adapting their offerings to meet these demands, indicating a shift towards more customized policies that align with the specific needs of diverse industries. This trend suggests that businesses are increasingly recognizing the importance of robust insurance solutions to mitigate potential financial losses.

Evolving Regulatory Environment

The Commercial Insurance Market is significantly influenced by the evolving regulatory landscape. Governments worldwide are implementing stricter regulations aimed at enhancing corporate accountability and risk management practices. This shift necessitates that businesses maintain adequate insurance coverage to comply with legal requirements, thereby driving demand for commercial insurance products. In recent years, regulatory changes have prompted companies to reassess their insurance needs, leading to an uptick in policy purchases. For instance, the introduction of new environmental regulations has resulted in increased interest in liability coverage, as businesses seek to protect themselves from potential legal repercussions. As regulations continue to evolve, the Commercial Insurance Market is likely to see sustained growth, as companies prioritize compliance and risk mitigation through comprehensive insurance solutions.

Increased Focus on Sustainability

The Commercial Insurance Market is witnessing a growing emphasis on sustainability and environmental responsibility. As businesses become more aware of their environmental impact, there is a corresponding demand for insurance products that address sustainability-related risks. Insurers are responding by developing policies that cover environmental liabilities and promote sustainable practices. This trend is particularly evident in industries such as construction and manufacturing, where companies are increasingly seeking coverage for green initiatives and eco-friendly projects. The market for environmental liability insurance is projected to expand significantly, reflecting the broader shift towards sustainability in business operations. This focus on sustainability not only enhances the reputation of companies but also aligns with the evolving expectations of consumers and stakeholders, thereby driving growth in the Commercial Insurance Market.

Globalization and Market Expansion

The Commercial Insurance Market is being propelled by the forces of globalization and market expansion. As businesses extend their reach into new markets, they encounter diverse risks that necessitate comprehensive insurance coverage. This expansion often involves navigating different regulatory environments, cultural nuances, and economic conditions, which can complicate risk management strategies. Insurers are adapting their offerings to cater to the needs of multinational corporations, providing coverage that addresses the complexities of operating in various jurisdictions. The increasing interconnectedness of markets is likely to drive demand for commercial insurance products that offer protection against international risks. In 2025, the Commercial Insurance Market is expected to benefit from this trend, as companies seek to safeguard their global operations through robust insurance solutions.

Technological Advancements in Risk Assessment

The integration of advanced technology in the Commercial Insurance Market is reshaping how insurers assess and manage risk. Innovations such as artificial intelligence, big data analytics, and machine learning are enabling insurers to evaluate risks more accurately and efficiently. These technologies facilitate the collection and analysis of vast amounts of data, allowing for more precise underwriting and pricing strategies. As a result, insurers can offer more competitive premiums while maintaining profitability. In 2025, it is anticipated that the adoption of these technologies will lead to a more streamlined claims process, enhancing customer satisfaction and retention. The Commercial Insurance Market is thus poised for transformation, as technology continues to play a pivotal role in shaping the future of risk management and insurance solutions.