Adoption of Data Analytics

The integration of data analytics into the Commercial Insurance Software Market is transforming how insurers assess risk and make informed decisions. By harnessing vast amounts of data, insurance companies can gain insights into customer behavior, market trends, and risk factors. This analytical approach enables more accurate pricing models and enhances underwriting processes. Recent studies indicate that insurers utilizing advanced data analytics tools can improve their loss ratios and operational efficiency significantly. As the demand for data-driven decision-making continues to rise, the Commercial Insurance Software Market is likely to see an influx of innovative software solutions designed to leverage analytics for competitive advantage.

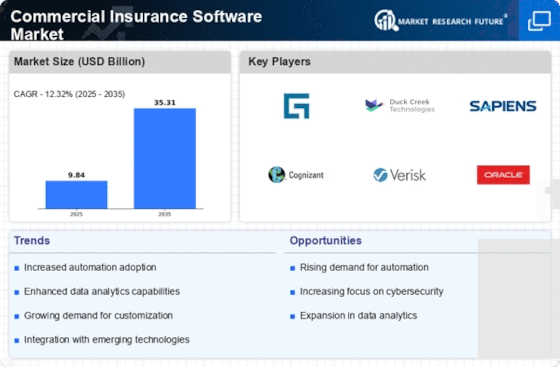

Rising Demand for Automation

The Commercial Insurance Software Market is experiencing a notable surge in demand for automation solutions. As businesses strive for operational efficiency, the integration of automated processes in insurance operations becomes increasingly vital. Automation not only streamlines workflows but also reduces human error, thereby enhancing overall productivity. According to recent data, the market for automation in insurance is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend indicates a strong inclination towards adopting software that can facilitate automated underwriting, claims processing, and customer service, ultimately transforming the landscape of the Commercial Insurance Software Market.

Emergence of Insurtech Startups

The Commercial Insurance Software Market is increasingly influenced by the emergence of insurtech startups. These innovative companies are disrupting traditional insurance models by offering agile, technology-driven solutions that cater to modern consumer needs. Insurtech firms often focus on niche markets, providing tailored products and services that challenge established players. The rise of these startups is fostering a competitive environment, prompting traditional insurers to adapt and innovate. Market data suggests that insurtech investments have surged, indicating a robust interest in developing cutting-edge software solutions. This trend is likely to reshape the Commercial Insurance Software Market, driving advancements in technology and customer engagement.

Increased Focus on Customer Experience

In the Commercial Insurance Software Market, there is a growing emphasis on enhancing customer experience. Insurers are recognizing that customer satisfaction is paramount for retention and growth. As a result, software solutions that provide personalized services, real-time communication, and seamless claims processing are in high demand. The market data suggests that companies investing in customer-centric software can see a significant increase in customer loyalty and retention rates. This shift towards prioritizing customer experience is likely to drive innovation and competition within the Commercial Insurance Software Market, as firms seek to differentiate themselves through superior service offerings.

Expansion of Digital Distribution Channels

The Commercial Insurance Software Market is witnessing a rapid expansion of digital distribution channels. Insurers are increasingly leveraging online platforms to reach a broader audience and streamline the purchasing process. This shift is driven by changing consumer preferences, as more clients prefer to engage with insurance providers through digital means. Market analysis indicates that the digital distribution of insurance products is expected to account for a substantial portion of total sales in the coming years. Consequently, software solutions that facilitate online transactions, customer engagement, and data analytics are becoming essential tools for insurers aiming to thrive in the evolving landscape of the Commercial Insurance Software Market.