Market Trends

Key Emerging Trends in the Collision Avoidance Sensors Market

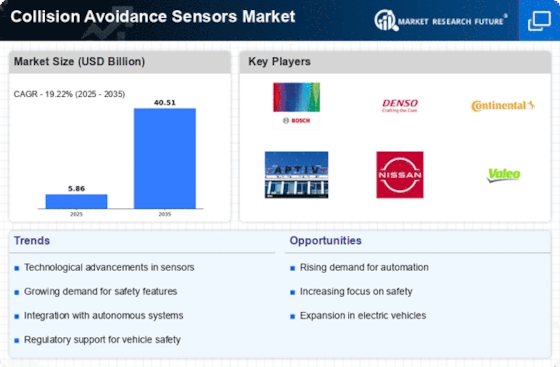

The Collision avoidance sensors Market is witnessing a slew of tendencies that are reshaping its landscape and riding the enterprise forward. One wonderful trend is the increasing integration of Artificial Intelligence (AI) and device-studying technology into collision avoidance systems. These advancements enhance the sensors' abilities to interpret complicated situations, predict ability collisions, and optimize responses in real time. Another distinguished trend is the growing adoption of the sensor fusion era. Sensor fusion entails combining records from more than one sort of sensor, along with radar, lidar, and cameras, to create a more comprehensive and dependable photograph of the automobile's environment. This trend addresses the limitations of character sensors and complements the general overall performance of collision avoidance systems. By leveraging the strengths of different sensor technologies, producers can provide extra sturdy solutions that offer a holistic method of detecting and avoiding ability collisions. The shift closer to 3-D imaging is also gaining traction inside the Collision avoidance sensors Market. Traditional 2D imaging systems are evolving into more superior 3-D imaging technology, supplying a more distinctive and correct representation of the surroundings. In response to the rising demand for sustainability and environmental consciousness, a wonderful fashion is the improvement of power-efficient collision avoidance sensors. Manufacturers are investing in technologies that reduce energy consumption without compromising performance. This trend is not only driven by environmental issues but also by the need for sensors to perform efficaciously in electric-powered and hybrid automobiles, wherein electricity conservation is a crucial component. As the automobile industry undergoes a massive shift closer to greener options, power-green collision avoidance sensors are becoming increasingly more applicable. The integration of V2X (Vehicle-to-Everything) communication is another rising trend in the collision avoidance sensors market. V2X technology permits automobiles to speak with each other and with infrastructure, sharing real-time facts about their positions, speed, and intentions. By incorporating V2X verbal exchange into collision avoidance systems, vehicles can alternate important facts, improving the general situational cognizance and allowing for more powerful collision avoidance strategies. Lastly, the growing consciousness of cybersecurity in connected vehicles is influencing the marketplace fashion for collision avoidance sensors. As motors become more related and rely upon complicated communication networks, ensuring the cybersecurity of those systems becomes paramount. Manufacturers are incorporating sturdy cybersecurity measures into collision avoidance sensors to guard against capability cyber threats and ensure the integrity of the safety-crucial records processed through those sensors.

Leave a Comment