Market Analysis

In-depth Analysis of Collision Avoidance Sensors Market Industry Landscape

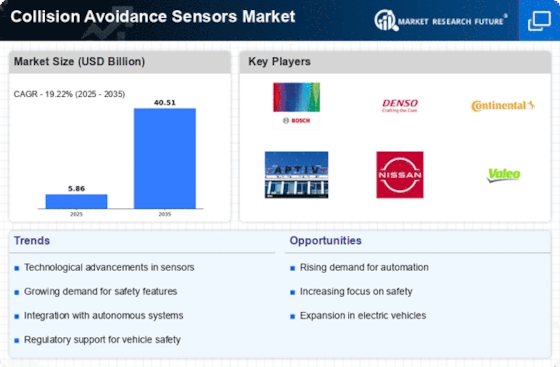

The Collision avoidance sensors Market is characterized by dynamic and ever-evolving marketplace forces that significantly affect its trajectory. One of the distinguished dynamics riding this market is the increasing awareness and emphasis on safety across diverse industries, particularly in automotive and transportation. As customers and regulatory bodies prioritize protection functions, the demand for collision avoidance sensors continues to push upward. The market dynamics are similarly formed with the aid of technological advancements in sensor technologies, along with radar, lidar, and cameras. Continuous innovation complements the abilities of those sensors, allowing greater correct and dependable collision detection and avoidance structures. Global regulatory frameworks and safety requirements additionally exert a good-sized effect on the market dynamics of collision avoidance sensors. As international governments implement stringent safety guidelines, manufacturers are compelled to comply with these standards, using innovation and the integration of superior safety technologies into cars and business packages. The alignment of marketplace gamers with regulatory requirements creates a unified push toward enhancing protection standards, contributing to the overall marketplace boom and stability. The rise of self-reliant and linked motors similarly influences market dynamics. As the automotive industry moves towards self-using abilities and accelerated connectivity, the demand for stylish collision avoidance sensors surges. These sensors grow to be quintessential components in ensuring the protection and reliability of self-reliant automobiles with the aid of offering real-time data on the vehicle's environment, permitting prompt responses to potential hazards. The financial component also plays a role in shaping the market dynamics. While the preliminary expenses of imposing collision avoidance structures may be a barrier, the lengthy period of price savings associated with the twist of fate prevention and decreased coverage premiums contribute to the market's boom. The price dynamics are stimulated by using elements along with economies of scale, technological improvements, and competition amongst manufacturers. Striking stability by providing notable answers and keeping affordability is important for the sustained market boom. Customer preferences and expectancies represent some other dimension of market dynamics. End-users, consisting of car manufacturers, fleet operators, and industrial establishments, increasingly prioritize features together with accuracy, reliability, and simplicity of integration while deciding on collision avoidance sensors. Market players want to stay attuned to purchaser needs and unexpectedly adapt their offerings to satisfy evolving expectations. Customization and versatility in sensor solutions emerge as key components of the marketplace dynamics, allowing manufacturers to cater to numerous consumer wishes. Market dynamics also are encouraged by the wider trends in transportation and business automation. As industries undertake smart and connected technology, the combination of collision avoidance sensors will become crucial for developing safer and more efficient systems.

Leave a Comment