Top Industry Leaders in the Collision Avoidance Sensors Market

The Competitive Landscape of the Collision Avoidance Sensors Market

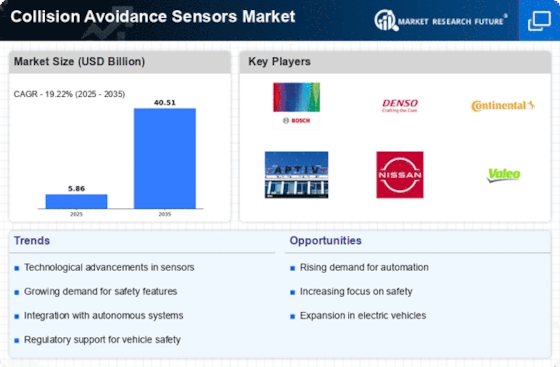

The collision avoidance sensors market, steering the automotive industry towards safer roads and smarter driving, pulsates with fierce competition. Understanding the strategies, key players, and future trends is crucial for businesses to navigate this dynamic terrain. Buckle up as we explore the intricate network of adopted strategies, factors influencing market share, rising newcomers, and the overall competitive scenario.

Key Player:

- Delphi Automotive LLP

- Continental AG

- Robert Bosch GmbH

- DENSO CORPORATION

- Texas Instruments

- Infineon Technologies AG

- Murata Manufacturing Co. Ltd.

- ALSTOM

- NXP Semiconductors

- Siemens AG

- Rockwell Collins

Strategies Adopted by Leaders:

- Technology Diversification: Leading players like Bosch and Continental Automotive are expanding beyond traditional radar and lidar sensors, offering camera-based systems, ultrasound solutions, and sensor fusion algorithms to cater to diverse vehicle types and needs. This broadens reach and attracts varied customers.

- Focus on Performance and Reliability: Reliable detection and accurate distance measurement are paramount. Valeo prioritizes high-resolution radar sensors for long-range detection, while Delphi Automotive focuses on lidar technology's precision in complex environments.

- Cost-Effectiveness and Scalability: Making collision avoidance systems affordable is crucial for wider adoption, especially in budget-conscious segments. Aptiv leverages economies of scale in sensor production, while Mobileye offers camera-based solutions with lower hardware costs.

- Software Development and Integrations: Advanced algorithms and software play a key role in interpreting sensor data and triggering alerts. NXP Semiconductors focuses on in-house software development for smarter decision-making, while Magna International collaborates with software startups to integrate AI capabilities.

- Partnerships and Acquisitions: Strategic partnerships with automakers, technology providers, and chipmakers accelerate development and market access. Denso's collaboration with Toyota on advanced driver-assistance systems and ZF Friedrichshafen's acquisition of WABCO highlight this strategy.

Factors for Market Share Analysis:

- Brand Reputation and Installed Base: Established players like Bosch and Continental Automotive hold an advantage with proven track records, extensive deployments in luxury and premium vehicles, and strong relationships with automakers. This legacy inspires trust and repeat business.

- Technology Portfolio and Breadth: Offering a diverse range of sensor types with varying capabilities and price points caters to different vehicle segments and customer needs. Continental Automotive's comprehensive portfolio of radar, lidar, and camera systems exemplifies this approach.

- Regulatory Compliance and Certifications: Meeting safety standards and regulations is crucial for passenger car applications. Delphi Automotive prioritizes compliance with international NCAP regulations, while Mobileye's systems often exceed regulatory requirements, attracting safety-conscious buyers.

- Focus on Niche Applications and Partnerships: Addressing specific needs can be lucrative. Valeo partners with truck manufacturers for collision avoidance solutions tailored to heavy vehicles, while Autoliv focuses on pedestrian and cyclist detection systems for urban environments.

- Data Security and Privacy Considerations: As sensors collect and transmit data, security concerns rise. NXP Semiconductors prioritizes security features in its software solutions, while ZF Friedrichshafen collaborates with cybersecurity experts to address data privacy issues.

New and Emerging Companies:

- Innoviz: Pioneering high-resolution lidar technology for autonomous vehicles and advanced driver-assistance systems.

- Quanergy: Leading the charge in solid-state lidar, offering cost-effective and compact solutions for wider adoption.

- Vayera Technologies: Focusing on software solutions for sensor fusion and advanced driver-assistance systems, making existing sensors smarter.

- Uhnder: Developing radar technology capable of mapping environments in 3D, enabling enhanced situational awareness and autonomous driving capabilities.

Latest Company Updates:

Delphi Automotive LLP:

- October 20, 2023: Delphi Automotive announces a partnership with Innoviz, a leading lidar technology provider, to integrate high-resolution lidar sensors into its advanced driver-assistance systems (ADAS), aiming for enhanced accuracy and long-range detection

- July 12, 2023: Delphi unveils its next-generation radar sensor with improved resolution and wider field of view, specifically designed for heavy-duty vehicles and trucks, enhancing safety for commercial fleets

Continental AG:

- October 17, 2023: Continental demonstrates its latest camera-based ADAS system with integrated object recognition and pedestrian detection capabilities, targeting Level 2+ semi-autonomous driving functionalities

- July 6, 2023: Continental partners with NXP Semiconductors to develop and integrate advanced software algorithms for sensor fusion and decision-making within their ADAS systems, aiming for smarter and more reliable performance