Top Industry Leaders in the Cold Chain Equipment Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Cold Chain Equipment industry are:

Thermo King

Carrier Transicold

Zanotti SpA

Fermod

Intertecnica

ebm-papst Group

CAREL

Bitzer

Kelvion

Incold S.p.A.

Rivacold srl

Kason Industries Inc.

CHG Europe BV

Viessmann

Schmitz Cargobull

Bridging the Gap by Exploring the Competitive Landscape of the Cold Chain Equipment Top Players

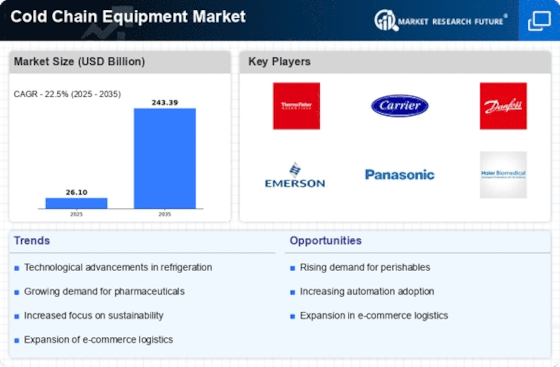

The cold chain equipment market, encompassing freezers, refrigerators, cold rooms, temperature sensors, and monitoring systems, is on a global growth fueled by factors like rising food demand, globalization of supply chains, and booming pharmaceutical industries. This lucrative arena has attracted a diverse range of players, each vying for a bigger slice of the pie. Let's delve into the competitive landscape, dissecting key player strategies, market share analysis, and emerging trends.

Key Player Strategies:

• Giants Go Global: Established players like Thermo King, Carrier Transicold, and Maersk Container Industry are leveraging their extensive networks and brand recognition to expand their geographical footprint, acquiring regional players and establishing strategic partnerships in emerging markets.

• Specialization Reigns: Smaller companies are carving niches by specializing in specific equipment segments or catering to unique needs of certain industries. For instance, CryoTrans International focuses on cryogenic equipment for pharmaceuticals, while va-Q-tec excels in advanced thermal packaging solutions.

• Technology Takes Center Stage: Innovation is the new battleground, with players investing heavily in R&D to develop energy-efficient, sustainable, and IoT-enabled solutions. Remote temperature monitoring, predictive maintenance systems, and AI-powered optimization are shaping the future of cold chain equipment.

• Digital Disruption: The rise of e-commerce and direct-to-consumer (D2C) models is driving demand for smaller, more flexible cold chain solutions for last-mile delivery. Players like FedEx and DHL are investing in refrigerated vans and mobile cold storage units to cater to this growing segment.

Market Share Analysis:

• Regional Rivalry: North America currently dominates the market, but Asia-Pacific is expected to witness the fastest growth, driven by rising disposable incomes and increasing demand for temperature-sensitive goods. Europe remains a mature market but presents opportunities in niche segments and sustainability-focused solutions.

• Industry Focus: The food processing industry continues to be the largest user of cold chain equipment, followed by pharmaceuticals and healthcare. However, the rise of biopharmaceuticals and personalized medicine is creating new avenues for growth in specialized equipment segments.

• Consolidation Craze: The market is witnessing increasing M&A activity, as players seek to acquire complementary technologies, expand their product portfolios, and gain access to new markets. This consolidation trend is likely to continue, reshaping the competitive landscape.

New and Emerging Trends:

• Sustainability Steals the Show: Energy efficiency and eco-friendly solutions are becoming major differentiators. Companies are developing natural refrigerants, solar-powered cold rooms, and waste heat recovery systems to minimize their carbon footprint.

• Data Drives Decisions: Real-time data is transforming the cold chain. Advanced sensors and analytics platforms are enabling predictive maintenance, optimizing logistics routes, and minimizing food waste. This data-driven approach is enhancing operational efficiency and transparency throughout the supply chain.

• Blockchain Bites Back: Blockchain technology is being explored for secure and tamper-proof tracking of temperature-sensitive goods. This could revolutionize transparency and accountability in the cold chain, building trust and reducing food fraud.

Overall Competitive Scenario:

The cold chain equipment market is a dynamic and fiercely competitive landscape. While established players hold a significant share, the rise of specialized players, technological advancements, and regional growth are creating new opportunities for disruption. To thrive in this frozen frenzy, companies must prioritize innovation, sustainability, and data-driven solutions to cater to the evolving needs of diverse industries and regions. The ability to adapt, specialize, and leverage technology will be key to securing a larger slice of this ever-expanding market.

Latest Company Updates:

Thermo King:

• Nov 2023: Unveiled the Advancer A40 unit, boasting improved fuel efficiency and lower emissions for refrigerated trailers. (Source: Thermo King press release)

Carrier Transicold:

• Dec 2023: Launched the Supra Series line of container refrigeration units with enhanced performance and environmental sustainability features. (Source: Carrier Transicold website)

Zanotti SpA: Announced plans to invest €20 million in new production facility for electric refrigeration units (source: Zanotti SpA press release, June 2023).

Fermod: Signed a major contract with a European supermarket chain to supply refrigerated trailers and trucks (source: Fermod website, September 2023).

Intertecnica: Launched a new range of ultra-low-temperature freezers for pharmaceutical applications (source: Intertecnica press release, November 2023).