Rising Demand for Perishable Goods

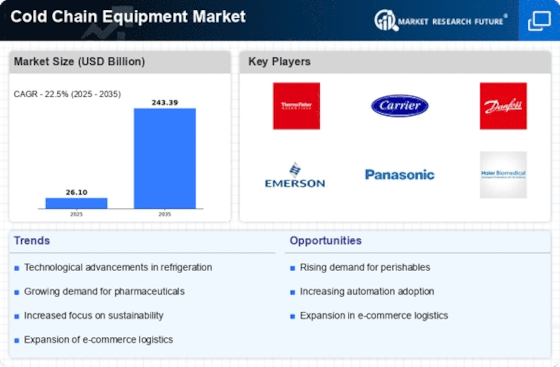

The increasing consumption of perishable goods, such as fresh produce, dairy, and pharmaceuticals, drives the Cold Chain Equipment Market. As consumers become more health-conscious, the demand for fresh and organic products rises. This trend necessitates efficient cold chain solutions to maintain product quality and safety. According to industry estimates, the market for perishable goods is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. Consequently, the Cold Chain Equipment Market must adapt to meet this growing demand, ensuring that temperature-sensitive products are stored and transported under optimal conditions.

Focus on Sustainability and Environmental Impact

Sustainability has emerged as a critical driver in the Cold Chain Equipment Market. Companies are increasingly prioritizing eco-friendly practices to reduce their carbon footprint and enhance their corporate social responsibility. The demand for energy-efficient cold chain solutions is on the rise, as businesses seek to minimize energy consumption and Waste Management. Recent studies indicate the at the market for sustainable cold chain technologies could grow by approximately 15% over the next few years. This focus on sustainability not only aligns with consumer preferences but also positions companies favorably in a competitive landscape, thereby influencing the trajectory of the Cold Chain Equipment Market.

Regulatory Standards and Compliance Requirements

The Cold Chain Equipment Market is heavily influenced by stringent regulatory standards and compliance requirements. Governments and health organizations impose regulations to ensure the safety and quality of temperature-sensitive products, particularly in the food and pharmaceutical sectors. Compliance with these regulations necessitates the use of advanced cold chain equipment, which can maintain precise temperature controls. As regulatory scrutiny intensifies, companies are compelled to invest in reliable cold chain solutions to avoid penalties and ensure product integrity. This trend is likely to drive growth in the Cold Chain Equipment Market as businesses seek to align with evolving compliance standards.

Technological Advancements in Cold Chain Solutions

Technological innovations play a pivotal role in shaping the Cold Chain Equipment Market. The integration of IoT devices, advanced monitoring systems, and automation enhances the efficiency and reliability of cold chain operations. For instance, real-time temperature tracking and data analytics allow for proactive management of project logistics. The market for smart cold chain solutions is expected to witness substantial growth, with projections indicating a potential increase of over 20% in the next five years, driven by rising adoption of Cold chain monitoring devices. These advancements not only improve operational efficiency but also reduce waste, thereby contributing to the overall sustainability of the Cold Chain Equipment Market.

Expansion of E-commerce and Online Grocery Delivery

The rapid expansion of e-commerce and online grocery delivery services significantly impacts the Cold Chain Equipment Market. As consumers increasingly prefer the convenience of online shopping, the demand for efficient cold chain logistics rises. E-commerce platforms require robust cold chain solutions to ensure that perishable items reach customers in optimal condition. Recent data suggests that the online grocery market is expected to grow by over 30% in the coming years, further emphasizing the need for advanced cold chain equipment. This trend compels stakeholders in the Cold Chain Equipment Market to innovate and enhance their offerings to meet the evolving needs of consumers.