By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. North America is accounting for 39.01 % of the market proportion in the year 2021 and it is projected to expand at a high CAGR of 5.30% in the forecast period of 2022-2030. The growing benefits associated with the consumption of coffee in the region are expected to increase its demand during the forecast period.

For instance, according to the American College of Cardiology, the largest benefit was associated with two to three cups of coffee per day, which equated to a 10%–15% decreased risk of coronary heart disease, heart failure, a cardiac rhythm issue, or passing away for any reason. People who drank one cup of coffee each day had the lowest risk of heart disease or stroke. Apart from this, the growing expansion policies adopted by major players operating in the region are expected to further contribute to its market growth.

As a part of this, in June 2022, Nespresso Professional expanded its momento coffee system portfolio with the addition of a momento coffee and milk machine. The momento coffee & milk machine use touchless technology and has been created to provide a variety of options, including lattes, macchiatos, espressos, and americanos. The presence of key players in the North America region such as Keurig Dr. Pepper and Starbucks Corporation is projected to fuel the growth of the North America market during the forecast period.

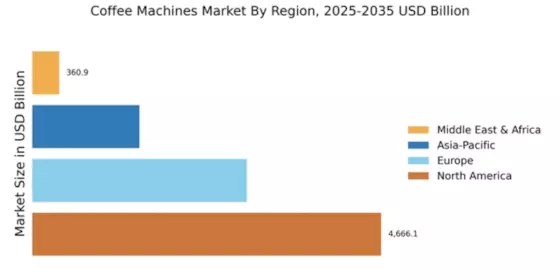

Figure 3: COFFEE MACHINES MARKET SHARE BY REGION 2021 (%)

Europe is also accounting for a significant market share in the Coffee machines market in the year 2021 and is expected to grow at a CAGR of 5.35% during the forecast period 2022-2030. The market in Europe is expected to grow significantly during the forecast period owing to the increasing demand for several specialty coffees, the development of new technologically advanced products, and rising demand for easy-to-use capsules/pod coffee and automatic bean-to-cup machines.

For instance, in May 2021, Lavazza Professional launched, Flavia Creation 600 (C600) coffee machines which the company describes as “the single biggest step-change Flavia has ever come across. The company also introduced a new selection of coffee alternatives to UK employees as part of a reinvented beverages menu in advance of the reopening of offices there. Strategic partnerships and collaborations between major players are expected to contribute to the growth of the market in the region. For instance, Nestlé S.A. and Starbucks Corporation entered into a long-term licensing partnership in May 2021.

According to the terms of this partnership, Nescafé is expected to market Starbucks’ products in Europe and Latin America. The key players operating in the region, especially in Italy, such as Nestlé S.A., The Tassimo Hot Beverage System, Luigi Lavazza S.p.A., and Dualit Limited, are boosting the growth of the market.