Diverse Flavor Profiles

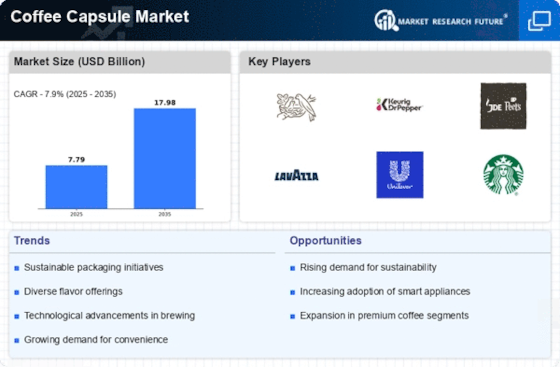

The coffee Capsule Market is increasingly characterized by the availability of diverse flavor profiles, appealing to a wide range of consumer preferences. As coffee enthusiasts seek unique and gourmet experiences, manufacturers are responding by offering an array of flavors, from classic espresso to exotic blends. This trend is supported by market data indicating that flavored coffee capsules account for a significant portion of sales, with a reported increase of 15 percent in flavor variety offerings over the past year. The introduction of limited edition and seasonal flavors further enhances consumer interest, driving sales and encouraging brand loyalty. As the demand for personalized coffee experiences grows, the coffee capsule Market is poised to benefit from this trend, attracting both casual drinkers and connoisseurs alike.

Convenience and Time Efficiency

The Coffee Capsule Market is experiencing a surge in demand due to the increasing preference for convenience and time efficiency among consumers. Busy lifestyles have led individuals to seek quick and easy solutions for their coffee needs. Coffee capsules offer a hassle-free brewing process, allowing users to prepare a fresh cup of coffee in mere minutes. This trend is particularly evident in urban areas where consumers often prioritize speed and efficiency. According to recent data, the coffee capsule segment has seen a growth rate of approximately 10% annually, indicating a strong consumer inclination towards ready-to-use coffee solutions. As more individuals embrace on-the-go lifestyles, the Coffee Capsule Market is likely to continue expanding, catering to the needs of time-constrained consumers.

Technological Innovations in Brewing

The Coffee Capsule Market is significantly influenced by technological innovations in brewing methods. Advances in coffee machine technology have enhanced the brewing experience, allowing for greater customization and control over the brewing process. Features such as programmable settings, temperature control, and pressure adjustments are becoming standard in new coffee machines designed for capsules. This technological evolution not only improves the quality of the coffee produced but also attracts tech-savvy consumers who appreciate modern conveniences. Market analysis indicates that the integration of smart technology in coffee machines is expected to grow, with a projected increase of 20% in sales of smart coffee machines over the next few years. As these innovations continue to emerge, the Coffee Capsule Market is likely to see increased consumer engagement and satisfaction.

Rising Coffee Culture and Premiumization

The Coffee Capsule Market is benefiting from the rising coffee culture and the trend towards premiumization. As consumers become more discerning about their coffee choices, there is a growing demand for high-quality, specialty coffee capsules. This shift is reflected in market data, which shows that premium coffee capsule sales have increased by approximately 12% in the last year. Consumers are increasingly willing to invest in premium products that offer superior taste and quality, leading to a proliferation of brands focusing on high-end offerings. This trend not only enhances the overall market landscape but also encourages competition among brands to innovate and differentiate their products. As the coffee culture continues to evolve, the Coffee Capsule Market is likely to thrive, driven by the pursuit of quality and unique coffee experiences.

Sustainability and Eco-Friendly Practices

The Coffee Capsule Market is witnessing a shift towards sustainability and eco-friendly practices, driven by increasing consumer awareness regarding environmental issues. Many consumers are now seeking products that align with their values, prompting manufacturers to innovate in terms of packaging and sourcing. Biodegradable and recyclable coffee capsules are becoming more prevalent, as companies strive to reduce their environmental footprint. Recent statistics suggest that eco-friendly products have seen a rise in market share, with consumers willing to pay a premium for sustainable options. This trend not only addresses consumer concerns but also positions brands favorably in a competitive market. As sustainability becomes a key purchasing factor, the Coffee Capsule Market is likely to evolve, with a growing emphasis on environmentally responsible practices.