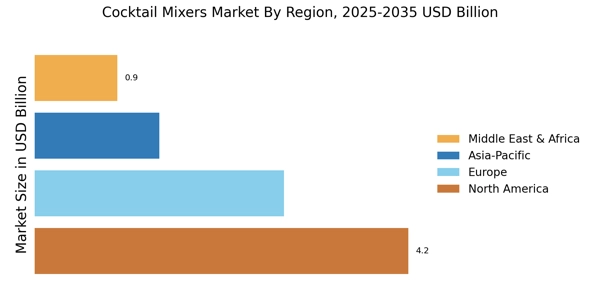

By Region, the the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Europe Cocktail Mixers Market accounted for USD 3.56 billion in 2022 and is expected to exhibit an 4.55% CAGR during the study period. Europe is expected to hold the largest share in the global cocktail mixer market during the forecast period, driven by the region's high levels of alcoholic beverage acceptance and consumption in countries like the UK, Germany, France, Spain, and Italy.

The growing popularity of cocktails among consumers in Europe is also attributed to the emergence of pubs and bartenders who are introducing super-premium beverages by combining premium tonic waters with high-end liquor brands. The development and use of alcoholic beverages and cocktail mixers like club soda and tonic water are also anticipated to benefit from socioeconomic reasons including growing urbanization and changing lifestyles in the UK, Germany, and France. This trend is expected to continue in the coming years as consumers seek out unique and premium cocktail experiences.

Further, the major countries studied are: The U.S, Canada, Mexico, UK Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, and Brazil.

Figure 3: COCKTAIL MIXERS MARKET SHARE BY REGION 2024 (%)

North America Cocktail Mixers Market accounts for the second-largest market share in 2022. In recent years, there has been a growing trend towards more sophisticated and nuanced flavours in cocktails, and consumers are willing to pay a premium for mixers that can help them achieve these flavours. This has led to the emergence of artisanal and craft mixers that use high-quality, natural ingredients to create unique and complex flavour profiles. The trend towards at-home cocktail consumption, particularly during the COVID-19 pandemic, has also contributed to the growth of the cocktail mixer market in North America.

As people spend more time at home, they are looking for ways to recreate the bar experience and experiment with new cocktail recipes, driving demand for mixers and other cocktail ingredients. Further, the U.S. Cocktail Mixers Market held the largest market share, and the Canada Cocktail Mixers Market was the fastest-growing market in the North America region.

The Asia-Pacific Cocktail Mixers Market is expected to grow at a CAGR of 5.90% from 2023 to 2030. The increasing demand for cocktails among consumers has led producers to introduce innovative cocktail mixers infused with various flavours, including cranberry, apple and cinnamon, and others, to cater to their preferences. Moreover, the Asian market has seen the entry of many foreign manufacturers who have successfully made inroads in the industry. Moreover, China Cocktail Mixers Market held the largest market share, and the Japan Cocktail Mixers Market was the fastest-growing market in the Asia-Pacific region.