Cocktail Mixers Size

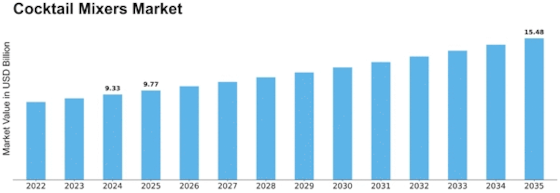

Cocktail Mixers Market Growth Projections and Opportunities

The Global Tonic Water Market is expected to grow by about 5.01% every year from 2022 to 2030, and it might reach around USD 3,717.63 million in 2030. The market is divided based on different things like the type of tonic water, how it's used, what's in it, how it's packaged, where it's sold, and where in the world it's sold. For example, the type of tonic water can be Flavored or Plain, and it's used in things like Alcoholic Drinks or for Direct Consumption. The content can be Regular or Diet, and it comes in packaging like bottles or cans. You can find it in places like Supermarkets, Convenience Stores, Specialty Stores, Online, and other places. The major regions in the market include North America, Europe, Asia Pacific, and the rest of the world.

The important companies in the global Tonic Water market include Fever-Tree, Dr. Pepper Snapple Group, A.S. Watson Group, Fentimans, Seagram Company Ltd, White Rock Beverages, Hansen Beverage Company, Inc, East Imperial, Bickford & Sons, Sepoy & Co., and many more.

Tonic water is becoming popular worldwide as a healthy drink. It's a fizzy drink that has quinine in it, which is a natural compound found in the bark of certain trees. These trees grow in places like Central and South America, Western Africa, and the Caribbean. Quinine is known for its ability to fight malaria and other illnesses caused by parasites, making it a good thing to have in tonic water. Tonic water is also low in sodium, saturated fat, has no cholesterol or gluten, making it a good drink for leisure. The demand for tonic water is going up because people like that it's good for them and has some health benefits.

However, there are rules about how much quinine can be in tonic water set by the FDA, limiting it to 83 milligrams per liter. This might affect the growth of the market. The approved amount of quinine for treating malaria is much higher, at 648 mg every 8 hours for 7 days. These rules could have an impact on the tonic water market in the future.

The market for tonic water was growing steadily because more people want premium and craft mixers in their drinks. Tonic water, being a fizzy drink with quinine, is often used as a mixer for alcoholic drinks like gin and vodka. As people get more interested in unique and tasty drinks, tonic water has become a popular choice. Also, with more people wanting low-calorie and sugar-free options, there's a rising demand for tonic water. Tonic water brands are also trying new flavors and packaging to match what people like. This trend is expected to continue as people's preferences evolve.

Leave a Comment