Emergence of IoT and Smart Devices

The image sensor market is being propelled by the emergence of Internet of Things (IoT) and smart devices, which require advanced imaging capabilities for various applications. As smart home technologies gain traction, the integration of image sensors in devices such as smart doorbells and security cameras is becoming increasingly common. In 2025, it is anticipated that the IoT segment will contribute significantly to the image sensor market, with a projected growth rate of 10% annually. This trend indicates a shift towards more interconnected devices, where image sensors play a crucial role in enhancing functionality and user experience.

Expansion of Automotive Applications

the image sensor market is expanding in automotive applications, driven by the increasing adoption of advanced driver-assistance systems (ADAS). These systems rely heavily on high-quality imaging for functionalities such as lane departure warnings and collision avoidance. In 2025, the automotive segment is expected to account for approximately 25% of the total image sensor market revenue. As safety regulations become more stringent, the demand for reliable imaging solutions in vehicles is likely to rise. This trend suggests that the image sensor market will continue to evolve, catering to the specific needs of the automotive industry.

Technological Advancements in Imaging

The image sensor market is experiencing rapid technological advancements, particularly in sensor design and manufacturing processes. Innovations such as back-illuminated sensors and stacked sensor architectures are enhancing image quality and performance. For instance, the introduction of 12 MP sensors in smartphones has led to a surge in demand, with the market projected to reach $20 billion by 2026. These advancements not only improve resolution but also enhance low-light performance, making them appealing for various applications, including automotive and security. As technology continues to evolve, the image sensor market is likely to witness increased competition among manufacturers striving to deliver superior products.

Growing Demand for Consumer Electronics

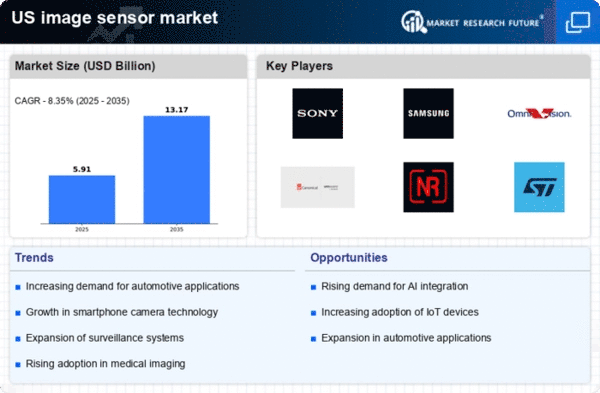

The image sensor market is significantly driven by the growing demand for consumer electronics, particularly smartphones, tablets, and cameras. In 2025, it is estimated that over 1.5 billion smartphones will be sold in the US, with each device incorporating advanced image sensors. This trend is further fueled by the increasing popularity of social media platforms, where high-quality images and videos are essential. The market for image sensors in consumer electronics is projected to grow at a CAGR of 8% from 2025 to 2030, indicating a robust expansion. As manufacturers strive to meet consumer expectations, the image sensor market is poised for substantial growth.

Surge in Security and Surveillance Needs

the image sensor market is influenced by the surge in security and surveillance needs across various sectors, including residential, commercial, and public spaces. With increasing concerns over safety, the demand for high-resolution cameras equipped with advanced image sensors is on the rise. In 2025, the security segment is projected to represent around 30% of the overall market share. This growth is driven by the need for enhanced monitoring capabilities and the integration of smart technologies in surveillance systems. As a result, the image sensor market is likely to see a continuous influx of innovative products tailored for security applications.